The Canadian market has shown a positive trajectory, rising 1.4% over the last week and climbing 24% in the past year, with earnings anticipated to grow by 15% annually in the coming years. In this favorable environment, identifying high growth tech stocks like Constellation Software requires focusing on companies that demonstrate strong innovation and adaptability to capitalize on this upward trend.

|

Name |

Revenue Growth |

Earnings Growth |

Growth Rating |

|---|---|---|---|

|

Docebo |

14.54% |

34.05% |

★★★★★☆ |

|

Constellation Software |

16.17% |

23.55% |

★★★★★☆ |

|

HIVE Digital Technologies |

49.31% |

94.00% |

★★★★★☆ |

|

GameSquare Holdings |

38.08% |

86.64% |

★★★★★☆ |

|

Medicenna Therapeutics |

62.37% |

57.20% |

★★★★★☆ |

|

Sabio Holdings |

12.97% |

122.50% |

★★★★☆☆ |

|

Blackline Safety |

22.29% |

121.23% |

★★★★★☆ |

|

BlackBerry |

24.17% |

76.20% |

★★★★★☆ |

|

Alpha Cognition |

62.98% |

69.54% |

★★★★★☆ |

|

Sernova |

76.56% |

74.04% |

★★★★★☆ |

Click here to see the full list of 23 stocks from our TSX High Growth Tech and AI Stocks screener.

Let’s explore several standout options from the results in the screener.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Constellation Software Inc. acquires, builds, and manages vertical market software businesses across Canada, the United States, Europe, and internationally with a market cap of CA$93.45 billion.

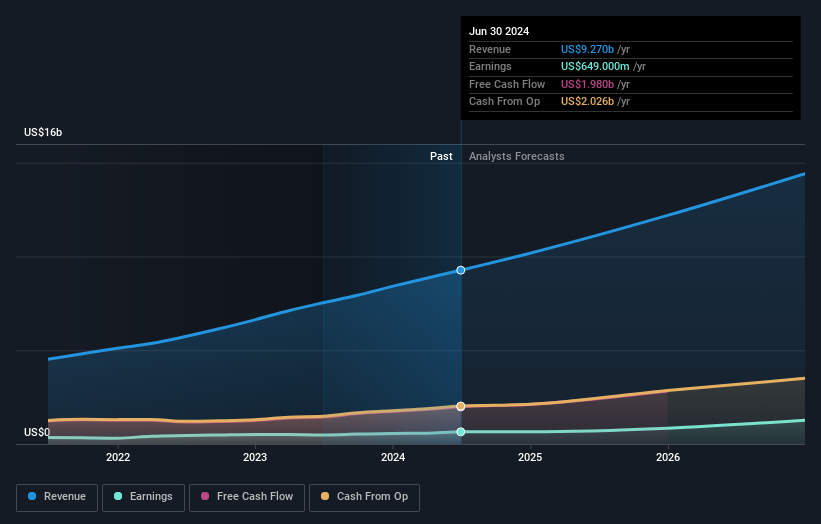

Operations: The company generates its revenue primarily from the Software & Programming segment, amounting to $9.27 billion. It focuses on acquiring and managing vertical market software businesses across various regions globally.

Constellation Software demonstrates robust growth, with a 33.5% increase in earnings over the past year, outpacing the software industry’s average of 1.9%. This momentum is reflected in its recent quarterly revenue surge to USD 2.47 billion from USD 2.04 billion year-over-year and a net income jump to USD 177 million from USD 103 million. Despite forecasts showing a slower revenue growth rate at 16.2% annually compared to more aggressive market averages, CSU’s earnings are expected to expand by an impressive 23.6% per year, surpassing the Canadian market forecast of 14.8%. The firm also maintains a strong commitment to shareholder returns, evidenced by its consistent dividend payouts, with the latest at $1 per share scheduled for October distribution.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Docebo Inc. is a company that offers an AI-powered learning management software platform, serving clients in North America and internationally, with a market cap of CA$1.89 billion.

Operations: The company generates revenue primarily from its educational software segment, which accounts for $200.24 million. The AI-powered platform supports diverse clients across North America and international markets.

Docebo’s strategic alignment with AI-driven learning solutions is evident from its recent partnership at the TEDAI Vienna event, underscoring its commitment to shaping future workplace education. This initiative complements Docebo’s impressive financial performance, with a 22% increase in sales to USD 53.05 million in Q2 2024 and a turnaround to a net income of USD 4.7 million from a previous loss. With R&D expenses consistently fueling innovation—14.5% of revenue dedicated to this area—the company is poised for sustained growth, notably with an expected annual profit surge of 34%.

Simply Wall St Growth Rating: ★★★★★☆

Overview: HIVE Digital Technologies Ltd. is involved in the mining and sale of digital currencies across Canada, Sweden, and Iceland, with a market capitalization of CA$568.74 million.

Operations: HIVE Digital Technologies Ltd. generates revenue primarily through the mining and sale of digital currencies, with its operations spanning Canada, Sweden, and Iceland. The company’s revenue from this segment amounts to $123.14 million.

HIVE Digital Technologies, with its impressive 49.3% annual revenue growth forecast, is outpacing the Canadian market’s average of 7.1%. This surge is underpinned by strategic expansions like the planned 100 MW mining operation in Paraguay, which promises significant U.S. dollar revenue and aligns with global Bitcoin demand increases. Despite current unprofitability and share dilution over the past year, HIVE’s aggressive R&D investment—14% of revenues—fuels innovation and supports a projected profit growth of 94% per year, positioning it for future profitability within three years.

Navigate through the entire inventory of 23 TSX High Growth Tech and AI Stocks here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St’s portfolio, where intuitive tools await to help optimize your investment outcomes.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:CSU TSX:DCBO and TSXV:HIVE.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com