- The Federal Reserve recently announced June’s CPI reports.

- However, most crypto assets, led by Bitcoin, did not respond to the recent report.

The recent Consumer Price Index (CPI) report released by the Federal Reserve did not trigger the expected positive reaction in Bitcoin’s [BTC] price.

This outcome was particularly surprising, as market observers anticipated the Fed rate cuts later in the year, which typically could boost investment in riskier assets like cryptocurrencies.

Possible reasons for the non-reaction

As market observers anticipated the impact of anticipated Fed rate cuts, the effects may have already been priced into current market prices.

Since the latter half of 2022, expectations of rate cuts have significantly influenced sentiment across the markets. This contributed to Bitcoin’s rise to record highs above $73,000 in 2024.

When rate cuts are implemented, they might provoke only a lukewarm market response. Moreover, BTC is experiencing substantial selling pressure from several quarters.

Notably, miners were selling off their holdings following the halving event and a subsequent drop in BTC’s price. This has compelled them to liquidate some of their reserves.

Additionally, the German government has been actively selling large quantities of BTC since the start of the month.

Market participants were also closely monitoring the potential sell-off from Mt.Gox; although these sales are likely to occur over-the-counter due to the large volume, they remain a focal point of attention.

These combined factors could be influencing Bitcoin’s lack of reaction to the fed rate cuts.

Read Bitcoin’s [BTC] Price Prediction 2024-25

BTC’s reaction to potential Fed rate cuts

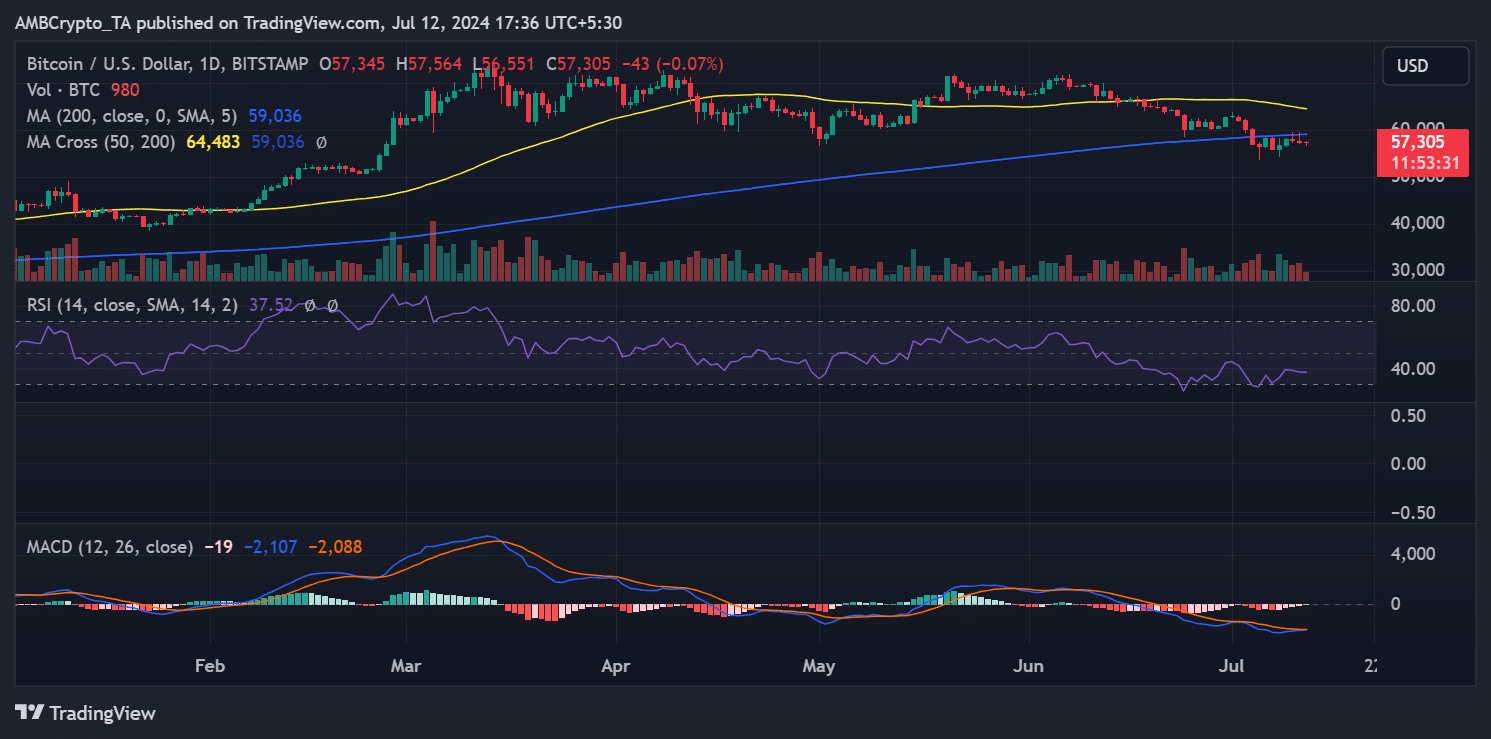

The analysis of Bitcoin’s price trend on a daily time frame indicated that it closed on the 11th of June with a 0.67% decline. It traded around $57,348 following the announcement of the CPI report.

As of this writing, BTC was trading at approximately $57,304, showing a slight further decline. The current price movement was bearish. This contrasted the expected positive reaction to the anticipated Fed rate cuts.