Visions/iStock via Getty Images

Match Group (NASDAQ:MTCH) has several positive aspects: it’s a company with globally recognized apps. It offers a product for which there will probably always be demand. They have good margins and buy back shares. However, the market currently assigns the company a relatively low valuation as user numbers have recently fallen, and overall EPS growth is only in the low single digits. Overall, this is a possible turnaround play. With surprisingly good figures in Q2, the share could leap upwards, but in my view, this is too much gambling.

The Match Group combines numerous well-known online dating apps and operates worldwide. Founded in 1986, the company currently employs around 2,600 people and offers services in around 40 languages. This is a positive aspect because it means the company is not dependent on one market. Demographic trends are quite negative in some countries and better in others, as is economic development. According to the company, the various apps have been downloaded over 750 million times.

match group investor relations

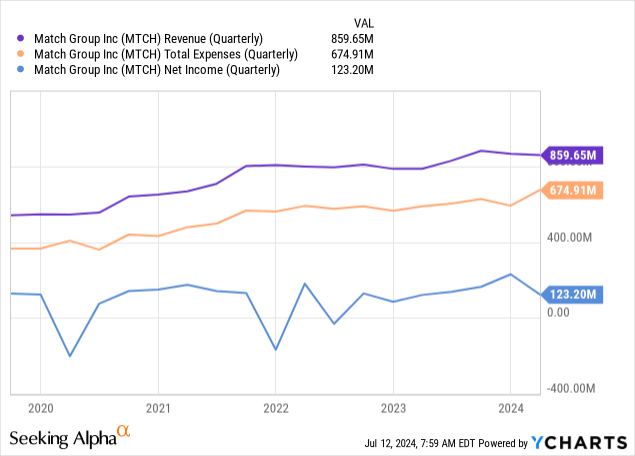

First, a short overview over a more extended period for revenues, expenses, and net income. This stock has experienced a significant pandemic boost, although costs have also risen to a similar extent. Sales have only grown slightly since 2022, and net income has stagnated for years.

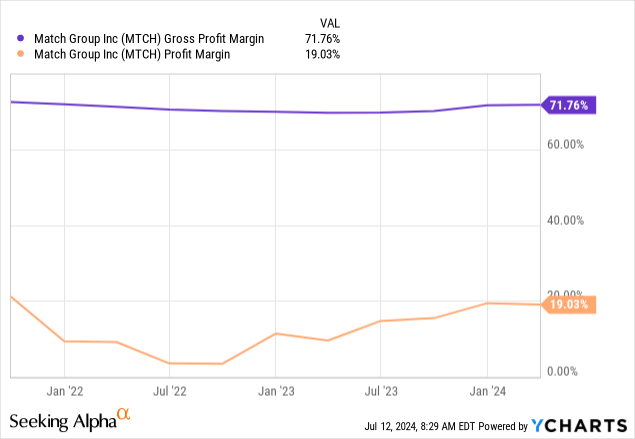

The margins look pretty good. The gross profit margin is constantly high, and the profit margin has been growing steadily for two years, indicating that the company has become more efficient or successfully implemented price increases.

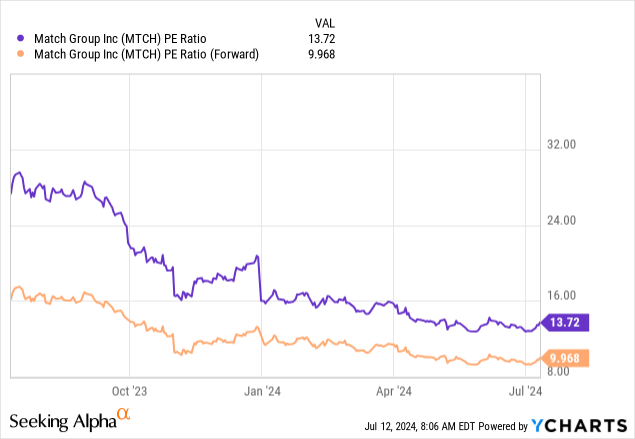

The company is currently valued at an enterprise value of $11.4B. Its market cap is $8.4B, so the net debt is about $3B. The following chart, especially the forward P/E ratio, shows a negative trend for several quarters.

According to the valuation tab on the Seeking Alpha page, there is no significant difference between the GAAP and non-GAAP earnings. I´m happy to see that because, for some companies, there are huge differences.

Although the company is active in numerous countries worldwide, sales are generated mainly in America and Europe. In terms of apps, it is primarily through the Tinder and Evergreen brands, but Hinge is still growing strongly, with 50% YoY.

Year-over-year, paying customers fell by 6% to 14.9M, a fairly significant drop. The following chart from the Q1 results shows that this has mainly happened in the American market. At the same time, however, the revenue per user (RPP = Revenue Per Payer) has also increased the most there. In other words, it appears that prices have been increased, which has led to numerous cancellations of former paying customers. In the following quarters, the company should show that it is able to return to a growth path.

The market currently attributes a relatively low valuation to the company, probably due to economic concerns that could weaken non-essential products such as dating apps and the fall in paying customers. However, this also means potential opportunities. If Tinder’s user numbers turn around and Hinge continues to perform well, the market could again attribute a higher valuation to the share, which could then lead to excellent returns over a short time. If the market were to value the share at a P/E ratio of 15, this would mean a 50% gain for the shareholder, and we know how quickly this can happen on the stock market.

In Tinder we have a highly profitable business and a focused strategy to improve trends. In Hinge we have the fastest growing major brand in the category, which we expect will increasingly impact overall Company results. Match Group expects to generate nearly $1.1 billion of free cash flow (“FCF”) in 2024. We are aggressively returning a large portion to shareholders, and we plan to continue doing so moving forward

But I argue that this low valuation is justified at the moment. The company is growing its EPS by only about 6% this year, and even this is only partly due to share buybacks. Why should a company with such weak growth be valued at a P/E ratio of 15 or more? No dividend is paid either. The company must prove that paying customers will stop falling and grow again. Price increases, as in the past, cannot be repeated yearly; moreover, Europe’s economic situation is poor, and a recession could follow in the USA. Dating apps are non-essential, and as inflation and/or weak economic growth pressures consumers, the stock market simply does not like slow-growing, non-essential products.

The dating app market is highly competitive overall, making it difficult for companies to build a sticky business model. The unfortunate (for the company) irony of dating apps is that if the app is “successful” in leading people into relationships, they will disappear afterward as paying customers. This differs from the business model of Netflix or Spotify, where people are willing to maintain their subscriptions for many years. The need for music is always there and stays, but not to find a partner.

Another headwind is the demographics in many countries, which are not favorable. The U.S. is still better off than Europe, but the general trend is toward an increasingly high average population age. The company also mentions weaker spending, which leads to challenges, especially for Tinder.

Tinder continues to see pressure on MAU and is also facing increasing pressure on à la carte (“ALC”) revenue, due in part to weaker consumer discretionary spending. Tinder is re-doubling its efforts to address these headwinds with ALC product adjustments and the introduction of new ALC features over the coming quarters.

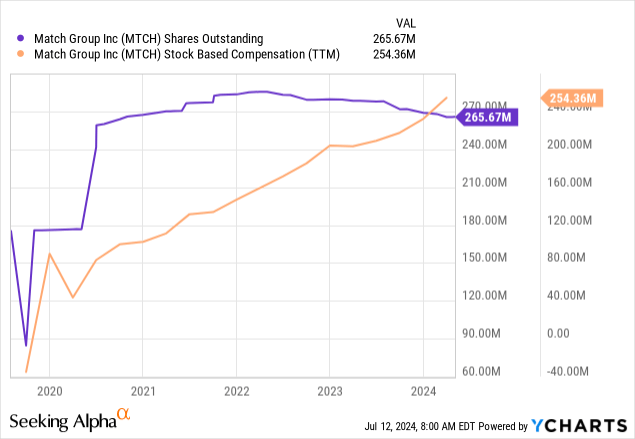

These three things are standard checks I make in every article, as excessive stock dilution and stock-based compensation can disadvantage shareholders. In addition, insider trades sometimes contain valuable information about management’s confidence. SBCs are huge in relation to net income ($654M in the last 12 months) and are still rising, while the net income remains rather stagnant. There are some buybacks – decreased the outstanding shares from $285M in December 2021 to now $265M; this means a reduction of 7%, which improves earnings per share by around 2.7% per year.

These are all insider trades from the last six months. There is not much going on here, which is a good sign.

The share is an interesting turnaround candidate. After all, this is a company with a globally recognized brand and good margins. However, the situation is not clear-cut; the share is still trending downward. If the next quarterly figures, published at the end of July 2024, are surprisingly good, the share could suddenly leap upwards. However, obviously, this is not guaranteed. If the figures are surprisingly poor, a further sell-off is possible. This is too much gambling for my taste. Therefore, I prefer to wait on the sidelines and watch the next quarterly results. In my view, currently is not the time to invest in low-growth non-essential stocks.

|

Investor’s Checklist |

Check |

Description |

|

Rising revenues? |

Yes |

Increasing over longer periods |

|

Improving margins? |

Yes (net income margin over the last two years) |

Possible competitive edge |

|

PEG ratio below one? |

No (10/6 = PEG ratio of 1.6; PE of 10 / EPS growth of about 6% this year) |

PEG ratio below one may suggest undervaluation |

|

Sufficient cash reserves? |

Yes |

Vital for the survival & growth, especially of unprofitable companies |

|

Rewards shareholders? |

Yes, buybacks |

Returning capital to shareholders |

|

Shareholder negatives? |

Quite high SBCs |

Actions that disadvantage shareholders |

|

Stock in an uptrend? |

No |

Trading above its 200-day moving average? |