(Bloomberg) — Asian stocks are set to drop after mixed US jobs data and a noncommittal Federal Reserve added to concerns the central bank may have waited too long to cut interest rates.

Most Read from Bloomberg

Equity futures in Australia, Japan and China point to steep losses in early trading. US equity futures edged lower after the S&P 500 fell 1.7% on Friday. The dollar was steady against major peers as traders priced in a roughly one-quarter chance of a 50-basis point Federal Reserve rate cut.

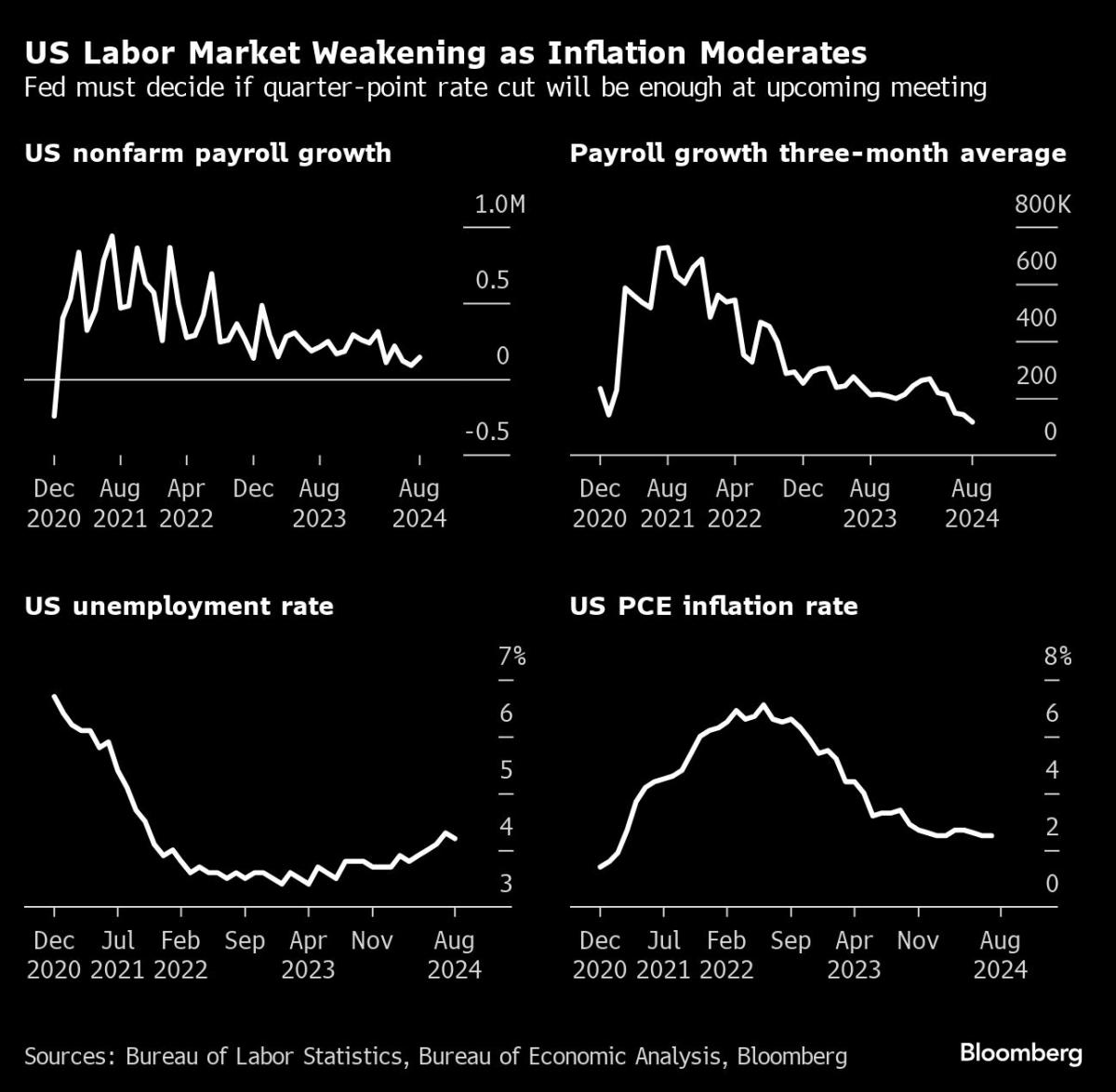

Data on Friday showed that nonfarm payrolls rose by 142,000 last month, leaving the three-month average at the lowest since mid-2020. The jobless rate edged down to 4.2%, the first decline in five months, reflecting a reversal in temporary layoffs. Hours later, Fed Governor Christopher Waller said he’s “open-minded” about the potential for a bigger rate cut.

“The mix of weaker employment data and a noncommittal Fed proved to be a toxic mix for risk,” said Chris Weston, head of research at Pepperstone Group in Melbourne. “Unless we see a more defined stance from the Fed, the combination of uncertainty toward pricing near-term Fed policy, weaker US/China/German growth and the AI-related plays lacking a bullish catalyst offers an elevated risk of further drawdown in growth-sensitive areas.”

September is proving a volatile month for markets as global stocks and commodities slumped amid fears of tepid global growth. More unease is likely as Chinese inflation and producer prices data later Monday may highlight the economic malaise that policymakers are struggling to counter.

Traders this week will be keeping a close eye on US inflation data as worries mount the Fed has waited too long to cut interest rates as recession risks grow. Treasury Secretary Janet Yellen at the weekend sought to temper fears, seeing no “red lights flashing” for the financial system and reiterated her view that the US economy has reached a soft landing even as jobs growth weakens.

The Fedspeak following the jobs print “did not indicate a sense of immediate urgency in needing to cut interest rates by 50 basis points,” said Diana Mousina, deputy chief economist at AMP Ltd. in Sydney. “So, a 25 basis point cut is more likely in September, with the risk of larger rate cuts if the data indicates the need for it.”

In Asia, Chinese assets will be in focus as officials attempt to lift sentiment by removing restrictions to foreign ownership in the manufacturing and health sectors. Seven & i Holdings Co. shares will be closely watched amid takeover offer speculation from Alimentation Couche-Tard Inc.

The People’s Bank of China kept its buying of gold on hold a fourth month in August, a further sign that prices near record highs are crimping global central bank demand.

Elsewhere this week, Donald Trump and Kamala Harris are set to face off in the US presidential debate amid a tight election race. The European Central Bank is tipped to cut interest rates.

In commodities, oil rose early Monday after dropping below $68 a barrel on Friday as the US jobs report added to concerns about tepid demand for crude.

Some of the main moves in markets:

Stocks

S&P 500 Futures fell 0.1% as of 7:29 a.m. Tokyo time

Nikkei 225 futures fell 3.3%

S&P/ASX 200 futures fell 1.3%

Hang Seng futures were little changed

Currencies

The euro was unchanged at $1.1084

The Japanese yen rose 0.1% to 142.15 per dollar

The offshore yuan was little changed at 7.0952 per dollar

The Australian dollar was little changed at $0.6669

Cryptocurrencies

Bitcoin rose 1.5% to $55,205.43

Ether rose 2.4% to $2,329.83

Bonds

Commodities

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.