On August 31, 2024, BlackRock Inc. (Trades, Portfolio), a prominent investment management firm, made a significant addition to its portfolio by acquiring 1,016,351 shares of EverQuote Inc. (NASDAQ:EVER), an online insurance marketplace. This transaction increased BlackRock’s total holdings in EverQuote to 3,175,010 shares, marking a strategic expansion in the interactive media sector. The shares were purchased at a price of $24.70 each, reflecting BlackRock’s confidence in EverQuote’s potential despite recent market fluctuations.

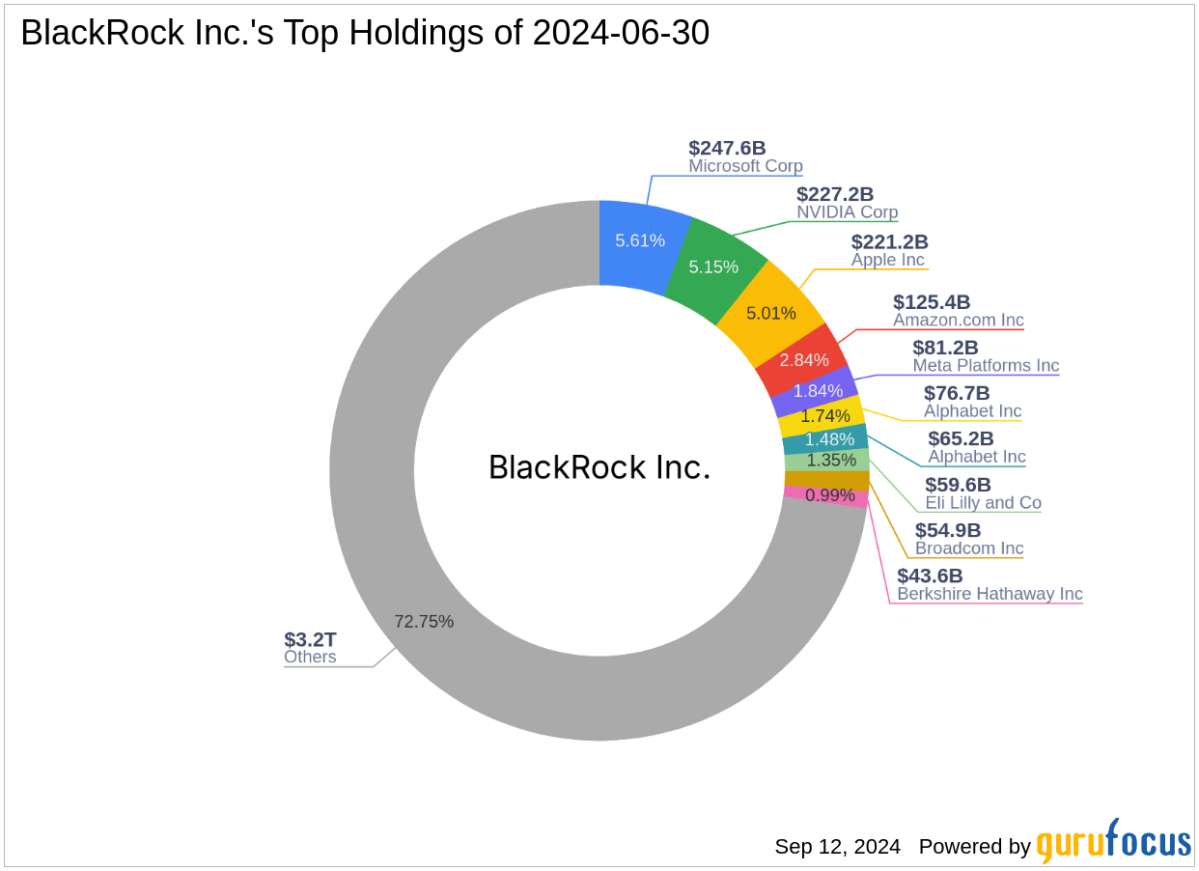

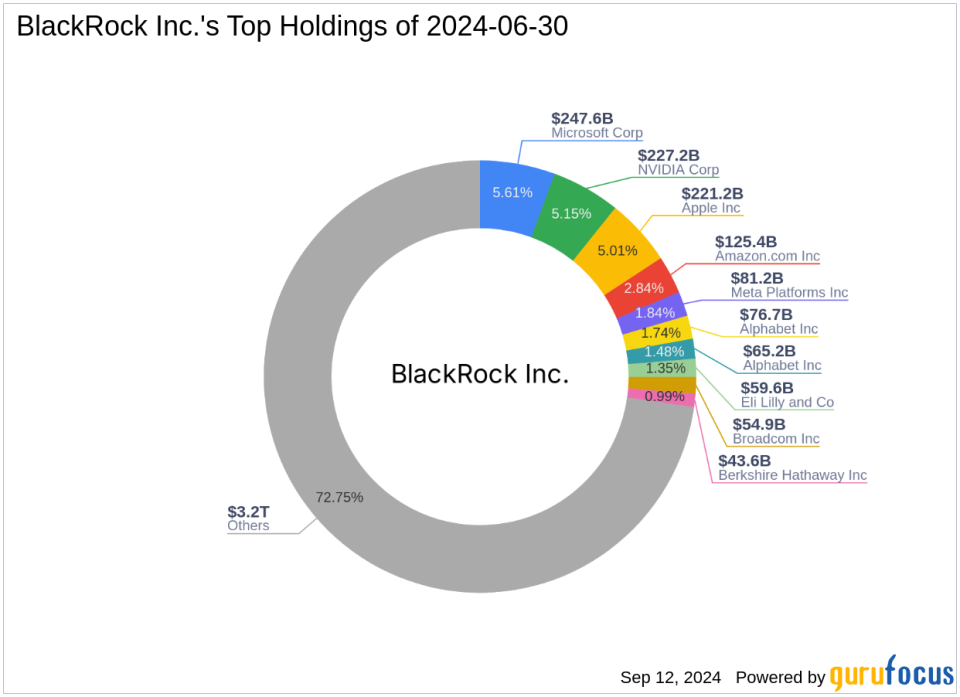

Founded in 1988, BlackRock Inc. (Trades, Portfolio) has grown into a global leader in investment management, risk management, and advisory services. The firm operates through a vast network of subsidiaries, with 21 investment centers and over 70 offices worldwide. BlackRock’s diverse offerings include mutual funds, ETFs under the iShares brand, and a robust risk management platform, BlackRock Solutions. This platform is integral to the firm’s operations, monitoring approximately 7% of the world’s financial assets.

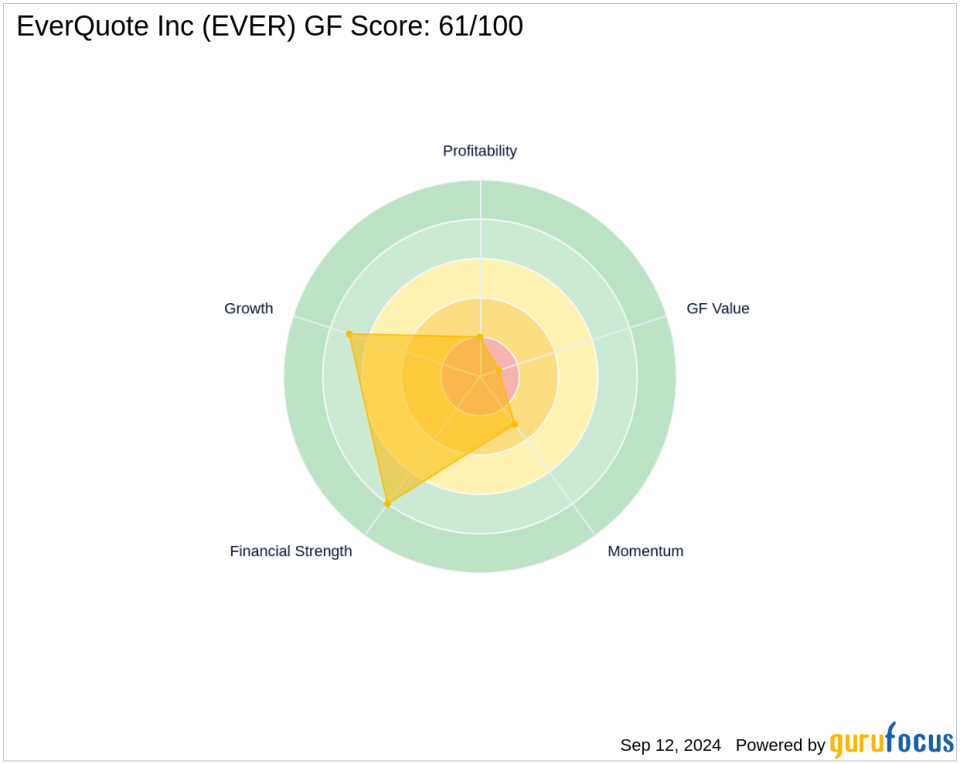

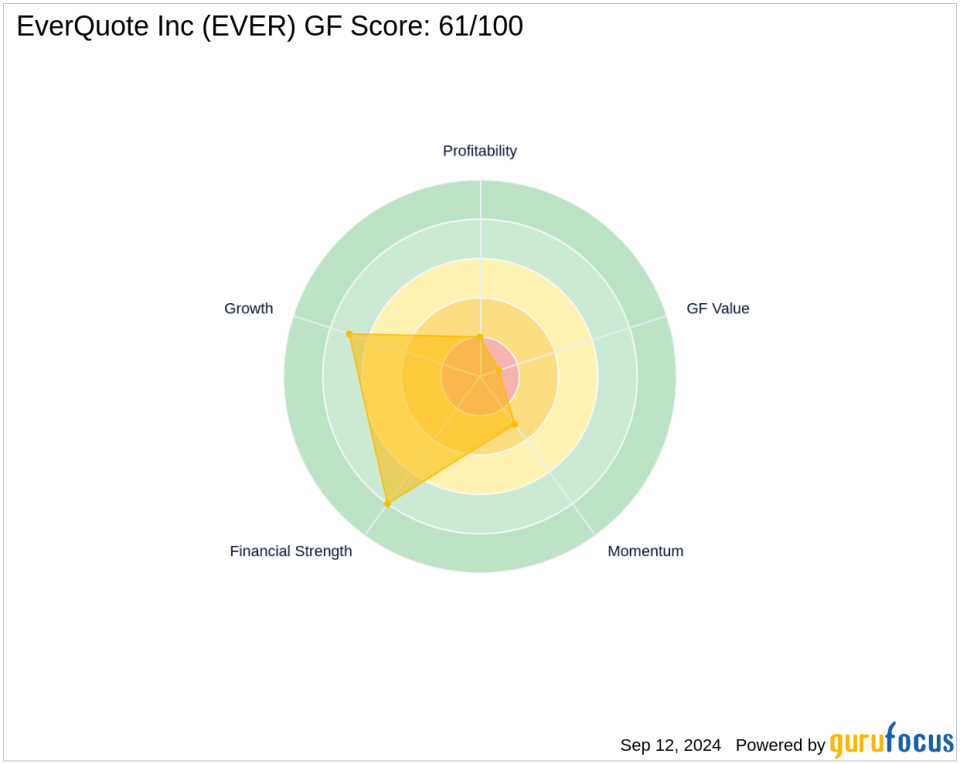

EverQuote Inc. operates a leading online marketplace for insurance, leveraging data science to connect consumers with relevant insurance providers. Since its IPO on June 28, 2018, EverQuote has focused on car, home, and life insurance quotes. Despite its innovative platform, the company is currently facing financial challenges, reflected in its “Significantly Overvalued” GF Value and a GF Score of 61/100, indicating poor future performance potential.

The recent acquisition by BlackRock involved shares valued at $24.70 each, significantly impacting their portfolio with a 10.10% position in EverQuote. This move aligns with BlackRock’s strategy of investing in technology and healthcare sectors, areas where it already holds substantial interests.

Following the transaction, EverQuote’s stock price experienced a downturn, currently standing at $20.65, which is a 16.4% decrease. This decline also reflects broader market trends and challenges within the interactive media industry. However, BlackRock’s substantial investment could provide a stabilizing effect on the stock’s performance going forward.

BlackRock’s acquisition of EverQuote shares is consistent with its investment philosophy, which emphasizes diversification and strategic growth in promising sectors. By increasing its stake in EverQuote, BlackRock is positioning itself to capitalize on potential growth in the digital insurance marketplace, despite the current financial metrics of EverQuote suggesting caution.

BlackRock’s position in EverQuote now stands as one of the significant stakes in the company, alongside other major investors like First Eagle Investment (Trades, Portfolio) Management, LLC. This strategic positioning by BlackRock underscores its commitment to investing in sectors that align with its long-term growth objectives, despite EverQuote’s current market challenges.

The recent transaction by BlackRock Inc. (Trades, Portfolio) to increase its holdings in EverQuote Inc. reflects a strategic move to strengthen its portfolio in the technology and healthcare sectors. While EverQuote’s current financial health shows signs of struggle, BlackRock’s investment might herald a turning point for the company, depending on future market dynamics and internal improvements within EverQuote.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.