Article content

All eyes will be on Canada’s job numbers tomorrow for clues not only on how the economy is faring but also what the Bank of Canada might do next.

Headline number out tomorrow won’t tell the whole story

All eyes will be on Canada’s job numbers tomorrow for clues not only on how the economy is faring but also what the Bank of Canada might do next.

Article content

Last month we got a surprise. A gain of 25,000 jobs was expected, but instead the economy lost 2,200 jobs and the unemployment rate shot up to 6.1 per cent, the highest in more than two years.

In fact, outside of the pandemic, Canada’s jobless rate hasn’t been above six per cent since 2017.

Advertisement 2

Article content

But job numbers are volatile and hard to predict, so it’s very possible that tomorrow’s reading could rebound, say economists.

Looking beyond the headline number, however, there are reasons to believe that Canada’s labour market is already weaker than it appears, argues CIBC economist Andrew Grantham in a recent note.

One is the economy’s reliance on public sector hiring, which serves to mask weakness in the private sector. Government jobs have driven more than 60 per cent of job growth over the past year, says CIBC. It estimates that if these jobs had only grown in line with the population and affected workers had not found employment elsewhere, Canada’s jobless rate would be 0.6 per cent higher.

Then there is the sticky question of counting non-permanent residents, who have seen their job prospects deteriorate the most over the past year.

The number of non-permanent residents has risen by about 1.5 million since 2019, according to population estimates, but Statistics Canada’s tally in the Labour Force Survey is an increase of only 600,000.

“With the unemployment rate for those non-landed immigrants that are counted having risen a lot more than the rest of the population over the past year, it’s possible that the jobless rate would actually be higher if a greater proportion of this group were included in the labour market data,” said Grantham.

Article content

Advertisement 3

Article content

CIBC estimates it would be 0.2 per cent higher. And while that might not seem like a lot, the divergence has only happened over the past nine months, which could signal an even weaker trend in the labour market than headline numbers suggest, said Grantham.

Why this is important is that CIBC suspects the Bank of Canada is using labour market data as a guide to assess slack in the economy.

“Because of this, understanding some of the idiosyncrasies of the labour market, and how, for example, the headline unemployment rate may not be a perfect guide of slack in the economy, will be important in determining when and how quickly interest rates need to come down,” said Grantham.

One thing we do know the Bank of Canada will be watching is wage growth which inched up to 5 per cent in March. RBC economists Nathan Janzen and Abbey Xu, however, say other indicators suggest this too may be slowing.

Payroll employment numbers showed wage growth about two percentage points lower than the Labour Force Survey, and the Bank of Canada’s business survey point to slower gains ahead.

Sign up here to get Posthaste delivered straight to your inbox.

Advertisement 4

Article content

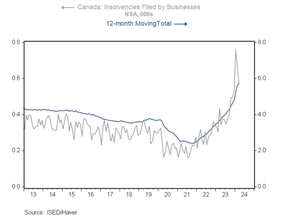

Don’t be fooled by one month of data is the lesson from today’s chart.

Business insolvencies in Canada pulled back in March after a spike early in the year following a pandemic-loan deadline. Monthly data can be volatile, but the 12-month trend shows insolvencies are clearly climbing higher, said Bank of Montreal economist Shelly Kaushik.

Over the past year, the highest number were in accommodation and food services which made up 15.5 per cent of the total. Construction accounted for 13 per cent and retail, 11 per cent.

“All three reflect discretionary spending (e.g., less renovations hitting construction), which has been struggling amid elevated interest rates,” said Kaushik.

Advertisement 5

Article content

About a third of all S&P 500 stock trades are now executed in the final 10 minutes of the session, and fresh evidence emerging from Europe — where the pattern is similar — suggests the trend may be hurting liquidity and distorting prices, giving new ammo to critics of the global boom in passive investing. Find out more at FP Investor

Recommended from Editorial

Are you worried about having enough for retirement? Do you need to adjust your portfolio? Are you wondering how to make ends meet? Drop us a line at aholloway@postmedia.com with your contact info and the general gist of your problem and we’ll try to find some experts to help you out while writing a Family Finance story about it (we’ll keep your name out of it, of course). If you have a simpler question, the crack team at FP Answers led by Julie Cazzin or one of our columnists can give it a shot.

Advertisement 6

Article content

Want to learn more about mortgages? Mortgage strategist Robert McLister’s Financial Post column can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Read them here

Today’s Posthaste was written by Pamela Heaven with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content