Article content

Willing to put off retirement and take on debt to make it happen

Article content

The cost-of-living crisis has a majority of Canadian parents “dreading” financing their children’s university education but still determined to go to the financial wall to give their kids the leg up they believe higher learning can provide, a new survey suggests.

Fifty-four per cent of parents said they dread the time when they have to start paying for their child’s university, according to a survey by Embark Student Corp., an education saving and planning company that manages approximately 600,000 registered education savings plans.

Advertisement 2

Article content

“Education savings not only has a financial impact on parents, but it can become a serious emotional burden,” Embark said in a press release.

So strong is the belief that university education is critical to success, that many parents are willing to make serious financial sacrifices.

For example, 66 per cent of parents would go so far as to put off retirement to help their child pay for university or college, while 57 per cent indicated they would be willing to take on debt to shoulder some of the costs found the data, which comes from a survey conducted for Embark by pollster Leger of 1,000 Canadian parents with children under 18 years of age.

“Nearly two-thirds of Canadian parents believe supporting their child is more important than their own financial health,” Embark said in a press release.

Delayed retirement and debt are sacrifices parents are contemplating in the future. In real time, some are already on a financial knife’s edge, as 55 per cent indicated they have had to eliminate some day-to-day “necessities” to help their kids financially and 43 per cent said they will have to go into debt to help their offspring cover the cost of education.

Article content

Advertisement 3

Article content

The price tag is significant.

Undergraduate education in Canada costs roughly $30,000 per year depending on where you are in the country, according to Embark.

The Government of Canada estimates tuition fees alone can range from $2,500 to $11,400 per year for Canadian citizens and permanent residents, based on the program and school the student is attending.

The latest yearly report from Statistics Canada on tuition fees, published in October, showed that the average yearly cost for Canadian undergraduates increased to $7,076, up 2.9 per cent from the 2022-2023 academic year.

Elevated inflation and higher interest rates have put the squeeze on education savings. Three-quarters of parents surveyed said “that with prices and the cost of living going up, they found it hard to save for their child’s future.” And 46 per cent said they had stopped saving for their child’s education, leaving 61 per cent to worry “that they have not saved enough” to send their child to school.

At the same time, 70 per cent worry about the amount of debt their child will be saddled with from the cost of education.

Advertisement 4

Article content

Student debt poses a significant financial burden.

Statistics Canada data from 2020 said 47 per cent of students owed debt at the time of graduation. The average amount of debt students were shouldering at the time of graduation was $25,000, while 31 per cent of graduates had more than $30,000 of student debt.

Three in four parents believe that post-secondary education is critical to their child’s success and that their child’s options will be “limited” if they don’t help with costs.

“Today’s parents are watching their children grow up during a difficult job market and volatile economic conditions, and they see how higher education can provide security for young adults,” Andrew Lo, chief executive of Embark, said in a press release.

Leger and Embark conducted the online poll between Feb. 21 and March 4, 2024.

— with a file from Victor Vigas, National Post

Sign up here to get Posthaste delivered straight to your inbox.

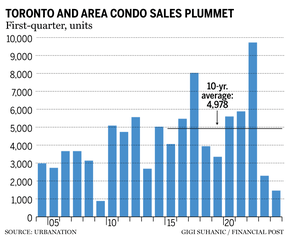

Sales of new condos in Toronto plunged in the first quarter of 2024 as a rising inventory of unsold units and soaring construction costs put a damper on the once booming market leaving some wondering if it has hit a wall. — Financial Post, Shantae Campbell

Advertisement 5

Article content

Recommended from Editorial

Advertisement 6

Article content

Young Canadians think retiring at 65 is an outdated concept with their views on that phase of life shifting dramatically as the cost of living rises and longer life expectancies become the norm. Read the full story here.

Are you worried about having enough for retirement? Do you need to adjust your portfolio? Are you wondering how to make ends meet? Drop us a line at aholloway@postmedia.com with your contact info and the general gist of your problem and we’ll try to find some experts to help you out while writing a Family Finance story about it (we’ll keep your name out of it, of course). If you have a simpler question, the crack team at FP Answers led by Julie Cazzin or one of our columnists can give it a shot.

Want to learn more about mortgages? Mortgage strategist Robert McLister’s Financial Post column can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Read them here

Today’s Posthaste was written by Gigi Suhanic, with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content