Article content

Ottawa’s hike to the capital gains tax has been slammed as a blow to Canada’s productivity, but closer to home, it will also hit your stock portfolio, say analysts.

Analysts say higher tax will cut returns from Canadian stocks

Ottawa’s hike to the capital gains tax has been slammed as a blow to Canada’s productivity, but closer to home, it will also hit your stock portfolio, say analysts.

Article content

The corporate tax increase “is the latest in a long line of decisions that for various, arguably legitimate reasons has reduced the returns investors can expect from Canadian public equities,” said analysts at CIBC Capital Markets.

Advertisement 2

Article content

Their report identifies three sectors that have been “consistently at the sharp end of the political stick” — banking, energy and communications.

It’s significant that these three sectors have generated half of S&P/TSX earnings over the past 10 years and also play heavily in retirees’ investment holdings because of their higher dividend yields.

The change proposed in this year’s federal budget will increase the capital gains inclusion rate from 50 per cent to two-thirds for corporations and individuals with gains over $250,000.

The higher taxes will reduce corporations’ profitability and return on equity and follow other government initiatives that have weighed on business, said the analysts.

In the 2022 budget, Ottawa imposed a 1.5 per cent income surtax on banks. Higher capital requirements, tax changes for dividends, initiatives in the Canadian Mortgage Charter, not yet law, and the intent to cap NSF fees, all threaten to reduce banks’ profits, they said.

Communications also face regulations aimed at encouraging competition in the sector, and in energy to limit carbon emissions.

Article content

Advertisement 3

Article content

“The high-yielding stocks in the banking, communications and energy sectors typically underpin Canadian retirement investment portfolios,” said the analysts.

“Policies that pressure ROE in these sectors can directly reduce the ability of these companies to grow dividends, and retiree income, over time.”

The upshot is that Canadian equities have become less appealing.

In recent years Canadian investors have been shifting away from domestic stocks to greener pastures, especially the United States, says CIBC.

U.S. world-beating performance can be explained by its global leaders, such as the tech companies in the Magnificent Seven, but another factor in the difference in gains has been the accumulation of taxes and regulations in Canada, said the analysts.

“These have penalized various sectors of the S&P/TSX that produce a disproportionate share of public company earnings.

Over the past 20 years, U.S. companies have been 40 per cent more profitable than Canadian companies, the analysts said, allowing them to either return more money to shareholders or reinvest in their businesses.

Advertisement 4

Article content

“It should come as little surprise that both individual and institutional investors are increasingly eschewing Canadian equities in favour of foreign assets,” they said.

Sign up here to get Posthaste delivered straight to your inbox.

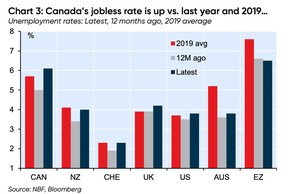

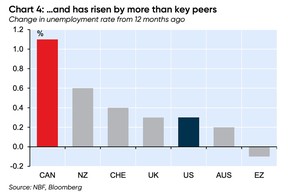

How does Canada’s economy stack up globally? Not great, says National Bank of Canada economist Taylor Schleich, who brings us today’s chart.

Labour markets have softened in most countries recently but Canada leads the pack with a gain in the unemployment rate of more than a percentage point. Our jobless rate is also one of the few above pre-pandemic levels and no country has surpassed their 2019 average by more, said Schleich.

Advertisement 5

Article content

There is due diligence in investing, which is the basic understanding of a company, its outlook and its financial picture. And then there is deep due diligence, where investors go beyond the norm and go that extra mile to get more information. Peter Hudson has some tips on how to get ahead of the pack in FP Investing.

Recommended from Editorial

Are you worried about having enough for retirement? Do you need to adjust your portfolio? Are you wondering how to make ends meet? Drop us a line at aholloway@postmedia.com with your contact info and the general gist of your problem and we’ll try to find some experts to help you out while writing a Family Finance story about it (we’ll keep your name out of it, of course). If you have a simpler question, the crack team at FP Answers led by Julie Cazzin or one of our columnists can give it a shot.

Advertisement 6

Article content

Want to learn more about mortgages? Mortgage strategist Robert McLister’s Financial Post column can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Read them here

Today’s Posthaste was written by Pamela Heaven with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content