(Bloomberg) — Signs that Chinese officials are pushing back on the record-breaking bond rally are deterring at least one group of investors that have been a key driver of recent gains.

Most Read from Bloomberg

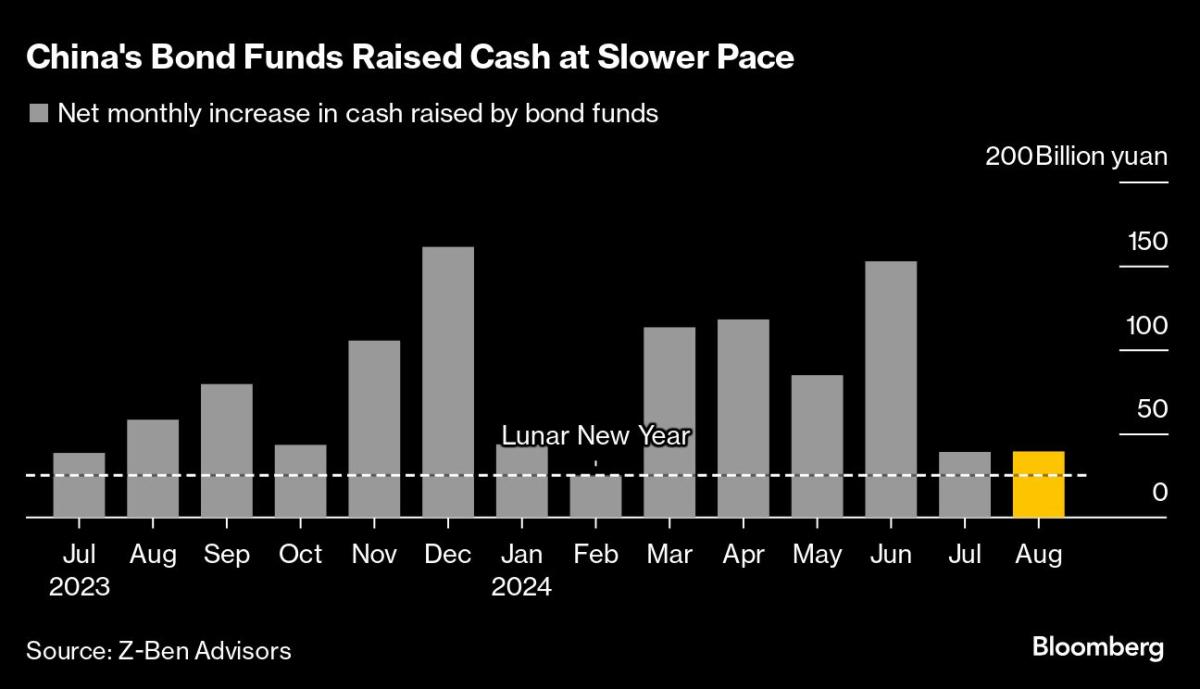

Net purchases of wealth-management products tumbled 90% in August from the previous month to just one-third of this year’s average, according to data from Puyi Standard. Meanwhile, cash raised by funds focusing on bond investments was 70% below this year’s high peak set in June, Z-Ben Advisors said.

The recent slide in inflows may be a sign the rush into the nation’s debt market is losing momentum, cooling a rally that has sent benchmark yields to record lows. The pressure may extend into September as the month typically sees an increase in redemptions from wealth-management products due to regulatory checks on financial institutions’ balance sheets, analysts say.

The turnaround comes as the authorities have stepped up their measures to rein in the rally from initial verbal warnings to more concrete measures such as selling the securities in the secondary market. The stabilization of deposit rates at major banks after a round of cuts in July also sapped demand for fixed-income funds and wealth products.

By the end of this year, mutual funds may “improve their management of liquidity and be more cautious,” said Zhou Guannan, chief fixed-income analyst at Huachuang Securities. “Looking forward, the fixed-income market is expected to be less active and investors’ passion for trading bonds will cool by October.”

Wounded by a property crisis, slumping stocks and unappealing deposit rates, investors had poured cash into WMPs for higher returns. Subsequently, a large chunk of that money was invested in the fixed-income market, sending benchmark sovereign yields down in all but two months this year.

That got Beijing concerned about financial risks, which can be caused by a spike in yields amid a market reversal.

Since August, the authorities have been ratcheting up measures to cool the bond rally. State lenders have been seen selling longer-maturity government debt in the secondary market over the past week, a sign the People’s Bank of China is trying to put a floor under yields.

“The absolute return of the bond market has declined,” said Qi Sheng, chief fixed-income analyst at Orient Securities. “Both the short-end and long-end bonds should fluctuate in a range.”

A growing sense of caution over the outlook for bonds, coupled with new administrative hurdles such as a slower approval process, has led to a decrease in new launches of fixed-income funds. Proceeds from new funds slipped to 39.3 billion yuan ($5.5 billion) last month, close to the lowest since February, according to Z-Ben Advisors.

A net 141 billion yuan of cash was invested in wealth-management products in August, down from 1.47 trillion yuan the previous month, according to the data compiled by Puyi Standard. Such products typically invest more than half of their capital in fixed-income assets and another 39% in money-market instruments, the consultancy said.

Despite the recent drop in demand, China’s government bonds are unlikely to enter a long-term decline and inflows from wealth-management products may pick up again in the fourth quarter, Orient Securities’ Qi said.

The PBOC is still forecast by economists to ease monetary policy later this year to support faltering growth, which is likely to benefit the bond market. The nation’s benchmark 10-year yield held near a record low of 2.09% on Friday.

“The chance of a negative feedback cycle of bond-market declines and significant WMPs redemptions at this stage is not high,” Minsheng Securities analysts led by Tan Yiming wrote in a research note this week. “But we should still pay attention to the disruptions caused by WMPs on the bond market. After all, the pace of fresh inflows is slowing.”

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.