(Bloomberg) — After enduring almost a quarter-trillion dollar hit to their market value in recent months, Europe’s luxury firms may see their stock-market clout wane further as China’s downturn worsens.

Most Read from Bloomberg

Once seen as Europe’s answer to the US “Magnificent Seven” tech megacaps, shares in companies producing high-end clothing, handbags and jewelry are languishing, sapped by a spending slump. Even more ominous are signs that China’s rich, who once flocked to upscale boutiques in Paris, Milan and Hong Kong, may not return, their appetite for pricey items extinguished by the economy’s downward spiral.

“This year is more volatile and more painful because it comes after this excessive growth,” Flavio Cereda, an investment manager at GAM UK Ltd. said, referring to the period immediately after the pandemic when consumers liberated from lockdowns splurged on shopping and travel.

For Britain’s iconic raincoat maker Burberry Group Plc, it’s culminating in ejection from London’s FTSE 100 stock index, with its market value down 70% in the past year. While it’s the only major brand to lose its index slot, an gauge of luxury shares compiled by Goldman Sachs has shed $240 billion in value from a March peak.

Gucci-owner Kering SA and Hugo Boss AG are the worst hit, shedding almost half their value in the past year. Kering, once a top 10 stock in France’s CAC 40 index, now ranks 23rd. And industry giant LVMH Moët Hennessy Louis Vuitton SE, which was Europe’s largest company by market cap a year back, has slid to second place.

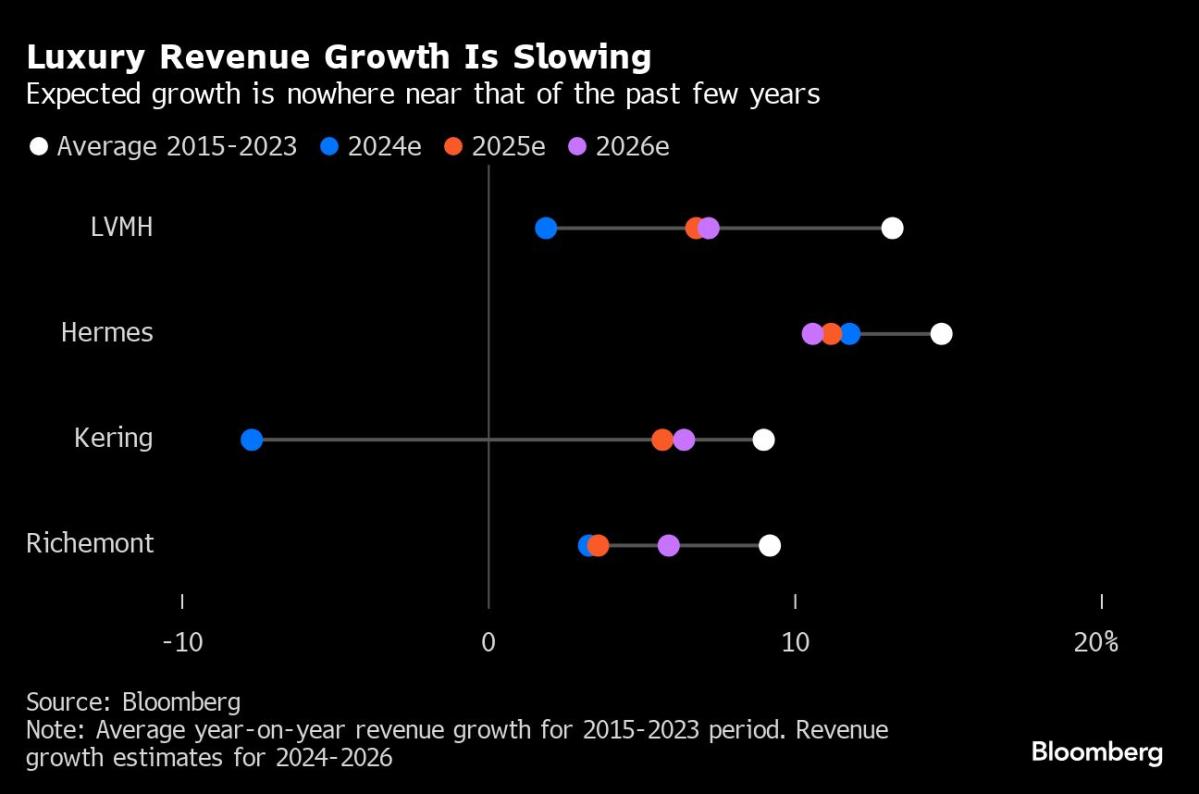

The deflation of the post-pandemic spending bubble was evident in recent earnings reports. Kering, Burberry and Hugo Boss issued profit warnings, while at LVMH, quarterly organic revenue at its crucial leather-goods unit grew just 1%, versus 21% a year earlier. Only brands catering to the ultra-wealthy, such as Hermes International SCA and Brunello Cucinelli SpA, escaped the full force of the earnings downturn.

“Slower for longer”

GAM’s Cereda, who co-manages a fund investing in luxury stocks, is hopeful sales will pick up next year, at least to the “mid-single-digit” levels that he says represent the sector’s long-term trend.

But what if weaker revenue and tighter profit margins are the new normal? Some reckon that could be the case.

UBS analyst Zuzanna Pusz describes the luxury-sector outlook as “slower for longer.” Trimming her estimates for organic sales growth in 2025 and the second half of 2024, Pusz predicted that “the industry seems to be entering its own specific cycle, following a few years of a boom with high pricing.”

And newsflow around the fallout of China’s slowdown seems to back that verdict.

Tiffany & Co., LVMH’s premium jewellery brand, is seeking to halve the size of its flagship Shanghai outlet, Bloomberg reported. Hong Kong’s luxury malls, which once lured big-spending Chinese, are nearly empty. And in Switzerland, watchmakers are seeking state aid to counter dwindling exports.

Many analysts share Pusz’s view, cutting estimates for profit and share prices. Bank of America Corp.’s Ashley Wallace says consensus expectations for the second half of the year may be too high, while Morgan Stanley’s Edouard Aubin names LVMH and Richemont as particularly vulnerable to the China slowdown, reducing his share targets for the firms.

Some see a silver lining in slightly more palatable share valuations. While the MSCI Europe Textiles Apparel & Luxury Goods Index still trades at a hefty premium to the MSCI Europe gauge, it’s well off the boomtime levels of 2021.

“The sector clearly has competitive advantages longer-term, so downcycles are probably the best time to invest,” Morningstar analyst Jelena Sokolova said. She sees an opportunity in Kering, predicting that strong brand recognition will enable Gucci to capitalize when the turnaround finally materializes.

GAM’s Cereda however, prefers the highest-end luxury names such as Hermes.

“You don’t want to own brands that don’t have brand heat, and you don’t really want any meaningful exposure to the aspirational consumer,” he said. “And you certainly don’t want any real exposure to the aspirational consumer in China.”

–With assistance from Michael Msika.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.