The Canadian market has climbed 1.2% in the last 7 days and an impressive 16% over the past year, with earnings expected to grow by 15% per annum in the coming years. In this thriving environment, high growth tech stocks that demonstrate strong earnings potential and innovative capabilities are particularly worth watching.

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Docebo | 14.71% | 33.96% | ★★★★★☆ |

| Constellation Software | 16.17% | 23.55% | ★★★★★☆ |

| HIVE Digital Technologies | 54.20% | 100.27% | ★★★★★☆ |

| GameSquare Holdings | 38.08% | 86.64% | ★★★★★☆ |

| Blackline Safety | 22.38% | 162.50% | ★★★★★☆ |

| Medicenna Therapeutics | 62.37% | 57.20% | ★★★★★☆ |

| Sabio Holdings | 12.97% | 122.50% | ★★★★☆☆ |

| BlackBerry | 20.61% | 76.74% | ★★★★★☆ |

| Cineplex | 7.33% | 179.27% | ★★★★☆☆ |

| Alpha Cognition | 62.98% | 69.54% | ★★★★★☆ |

Click here to see the full list of 24 stocks from our TSX High Growth Tech and AI Stocks screener.

Let’s uncover some gems from our specialized screener.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Docebo Inc. is a learning management software company that offers an AI-powered learning platform across North America and internationally, with a market cap of CA$1.77 billion.

Operations: Docebo Inc. generates revenue primarily from its AI-powered learning platform, with educational software contributing $200.24 million. The company’s market cap stands at CA$1.77 billion.

Docebo’s recent appointment of Alessio Artuffo as CEO, a seasoned executive within the learning industry, underscores its strategic focus on leadership stability and market expansion. This move coincides with a robust financial performance, where Q2 sales surged to $53.05 million from $43.59 million year-over-year and net income flipped to $4.7 million from a loss of $5.67 million, reflecting operational efficiency and market penetration depth. Furthermore, with R&D expenses consistently fueling innovation—evident from a 130.2% earnings growth surpassing the software industry’s 1.9%—Docebo is poised for sustained growth, especially considering its revenue projections indicating an 18-19% increase by year-end.

This trajectory is bolstered by Docebo’s proactive share repurchase strategy; having reacquired shares worth CAD 6.92 million recently highlights confidence in its financial health and shareholder value enhancement strategy. With earnings expected to climb by 34% annually, significantly outpacing the Canadian market forecast of 15%, Docebo’s strategic initiatives seem well-aligned with its ambitious growth targets in the evolving tech landscape.

Simply Wall St Growth Rating: ★★★★☆☆

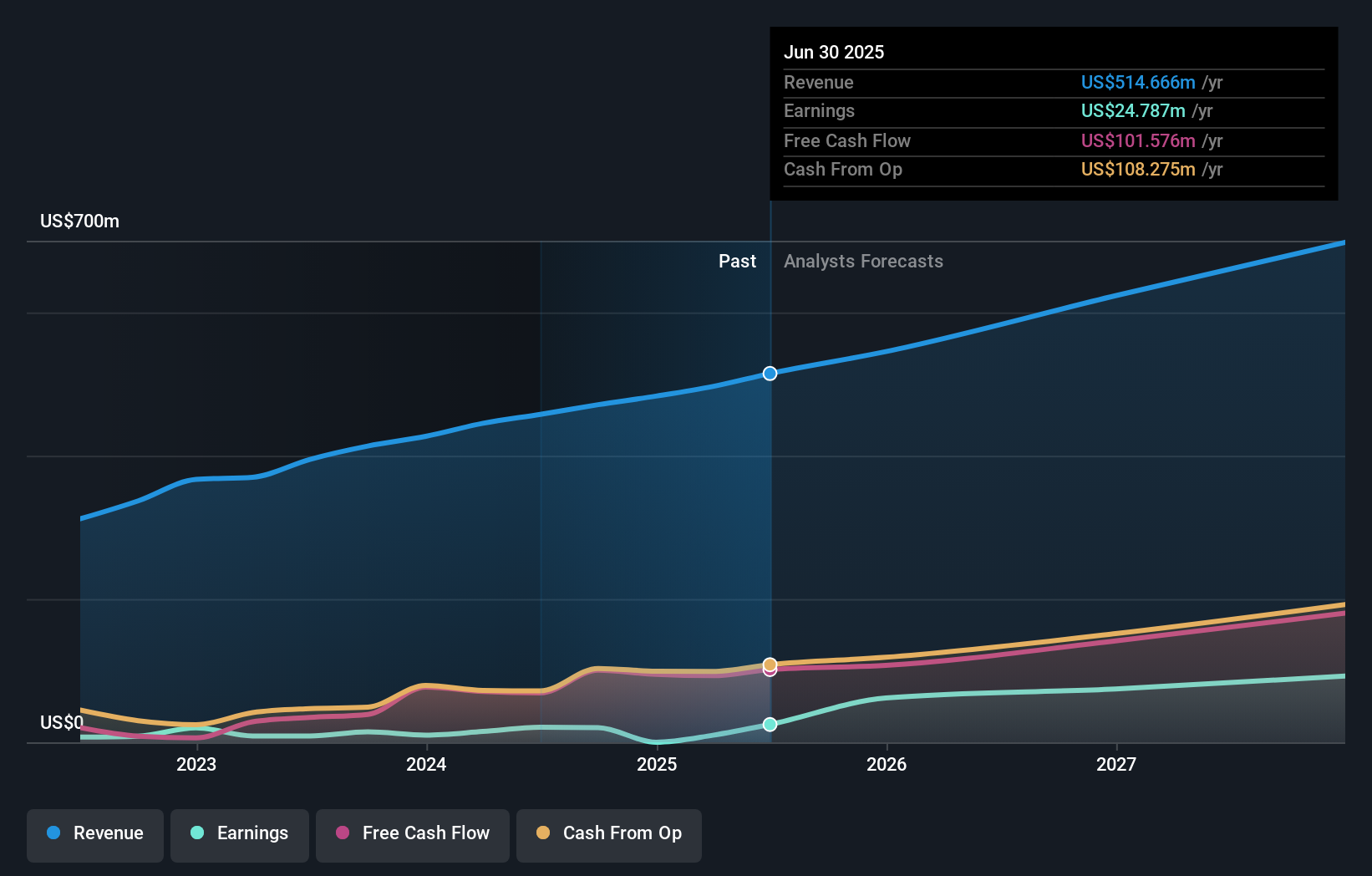

Overview: Kinaxis Inc. provides cloud-based subscription software for supply chain operations in the United States, Europe, Asia, and Canada and has a market cap of CA$4.32 billion.

Operations: Kinaxis Inc. generates revenue primarily through its cloud-based subscription software for supply chain operations, amounting to $457.72 million. The company operates in multiple regions including the United States, Europe, Asia, and Canada.

Kinaxis, amidst investor activism and leadership transitions, remains a formidable player in the supply chain management software sector. The company’s strategic focus is underscored by its recent R&D investment, crucial for maintaining its competitive edge in a market poised to reach $16 billion. Notably, Kinaxis reported a robust 14.9% revenue growth this year and anticipates earnings to surge by 48.9%. These figures reflect not only resilience but also an aggressive pursuit of innovation, as evidenced by their AI-driven platform Maestro which continues to set industry benchmarks. This approach could well position Kinaxis to capitalize on emerging market opportunities despite current challenges.

Simply Wall St Growth Rating: ★★★★☆☆

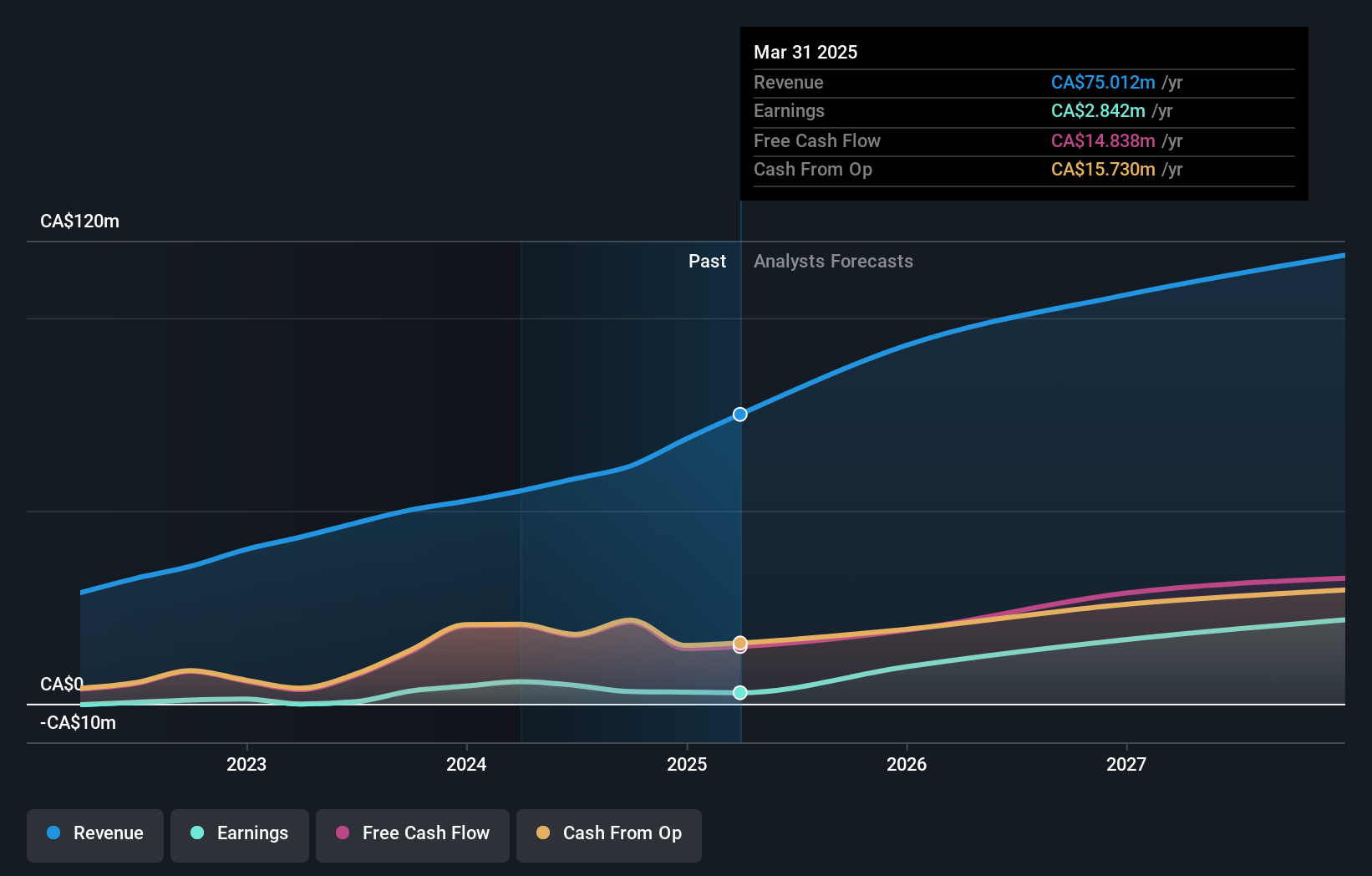

Overview: Vitalhub Corp. and its subsidiaries offer technology solutions for health and human service providers across Canada, the United States, the United Kingdom, Australia, Western Asia, and other international markets with a market cap of CA$457.68 million.

Operations: Vitalhub Corp. generates CA$58.32 million in revenue from its healthcare software segment, providing technology solutions to health and human service providers across multiple countries. The company has a market cap of CA$457.68 million.

Vitalhub, navigating through a transformative phase, reported a significant uptick in revenue to CAD 16.24 million in Q2 2024 from CAD 13.09 million the previous year, showcasing a growth trajectory despite a shift from net income to a net loss of CAD 0.335 million in the same period. This performance is underpinned by an aggressive R&D strategy which saw expenses aligned with fostering innovation crucial for staying competitive in the tech-driven healthcare sector. Impressively, Vitalhub’s earnings are projected to surge by 65.9% annually, outpacing the broader Canadian market’s growth rate of 15.1%, reflecting its potential to leverage technology for substantial market gains amidst evolving industry dynamics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Discover if Kinaxis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com