- The altcoin season index showed investors need to bide their time.

- Participants will need to be more picky in their altcoin bets this cycle due to the inundation of new tokens.

Bitcoin [BTC] was trading at $61.5k at press time, just 3% above the range low of $59.7k. This range low was defended in the first half of May and the bulls drove a rally to $72k but were unable to keep it going.

The revisit to this pivotal support meant that the consolidation phase was still in play and BTC was not ready to trend upward yet. The liquidity cluster below $60k could attract prices to it, thereby forcing a deeper correction than most participants expect.

When the king of crypto struggles to establish an uptrend after the halving, it is logical that most altcoins also suffer from bearish pressure. The capital inflow to sustain altcoin rallies is not present yet.

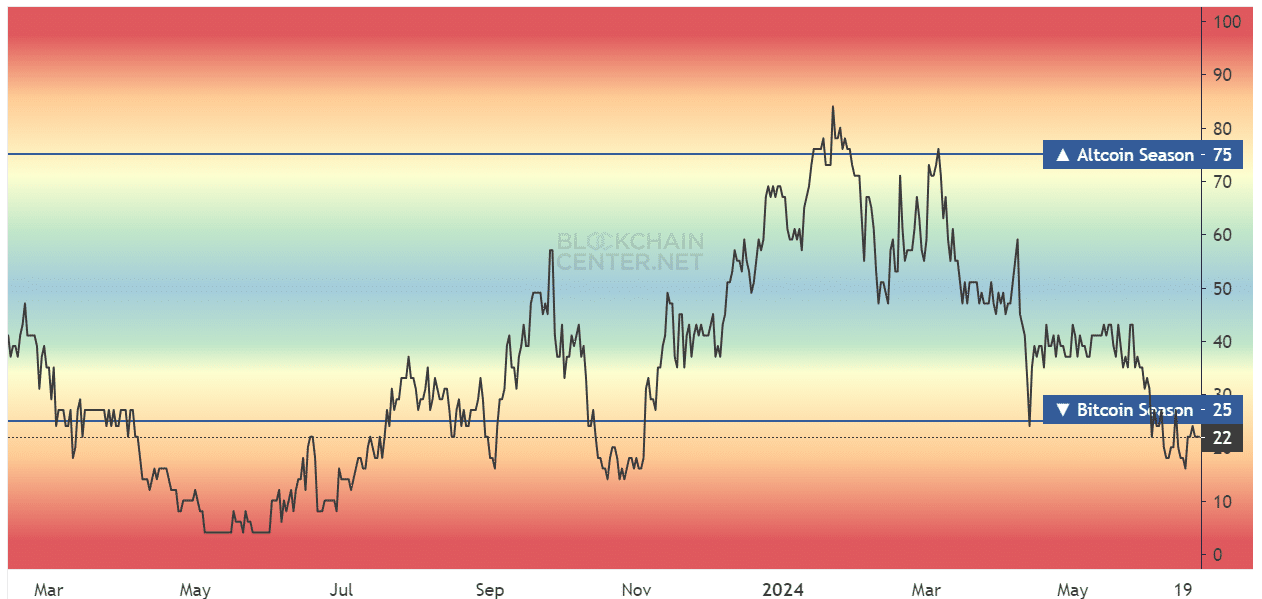

Investigating the altcoin season index- the readings are not hopeful

Source: Blockchain Centre

The altcoin season index tries to measure the sentiment in the market and whether Bitcoin or the altcoin sector is performing better. If 75% of the top 50 altcoins perform better than BTC over a 90-day window, it is said to be altcoin season.

We are far from such a scenario coming into play. This is because the market lacks the kind of capital inflows and speculative interest that propels an altcoin season.

Traditionally, once Bitcoin puts up a large upward move, it tends to consolidate. During this time, BTC holders choose to rotate some of their money into altcoins, betting on outsized gains in assets much riskier than BTC based on fundamental analysis, tokenomics, and market sentiment.

Therefore, before an altseason can occur, we will need Bitcoin to make large gains, as it did from October 2023 to January 2024.

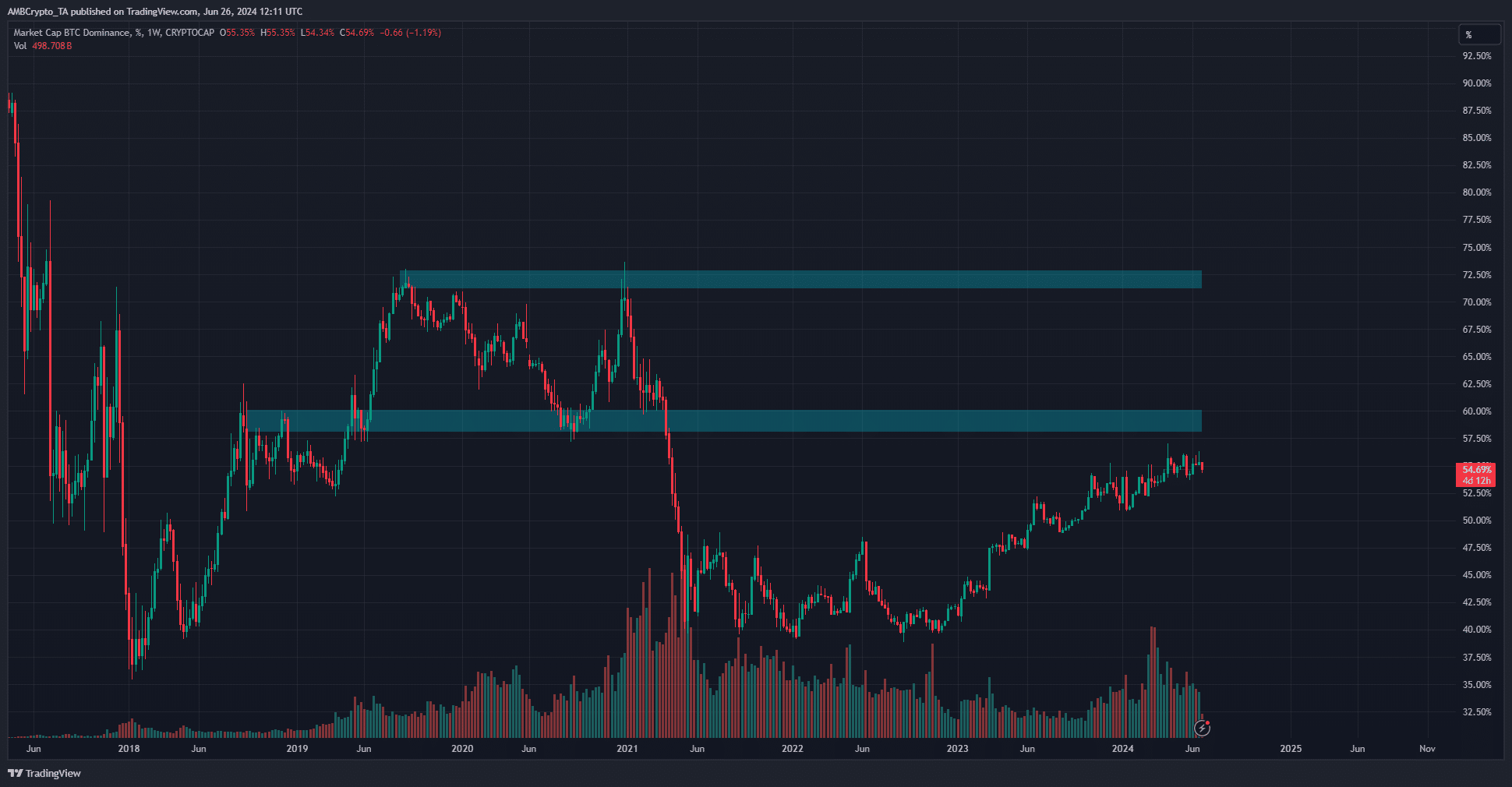

The long-term implications from the dominance chart

The 2021 altcoin season officially stretched from March to June 2021, based on the altcoin season index. However, studying the BTC.D chart above, we see that Bitcoin dominance began to trend downward in early 2021 and initiated a recovery in the second half of the same year.

Hence, a sharp dip in BTC.D is a key catalyst to altcoin seasons- it highlights the growth of the altcoin sector compared to Bitcoin.

Since March, the altcoin market has been in a bearish trend. While the higher timeframe trend has been positive, the current pullback has been brutal.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The dilution of the altcoin pool and the constant token unlocks from the existing projects meant that demand had to step up mightily just to keep up with the inflating altcoin market.

In turn, this could see extraordinary gains concentrated among fewer alts this cycle than in 2021 or 2017, and the returns might be more diminished than in previous cycles as well since participants are no longer early.