(Bloomberg) — The European Central Bank will probably cut interest rates on Thursday in a prelude to a US move the following week, as the global monetary cycle tilts toward more synchronized easing.

Most Read from Bloomberg

Euro-zone officials have signaled that they’ll deliver a second reduction in borrowing costs, following up on July’s move, which will be scrutinized by investors looking for policymakers’ intentions for any further steps later this year. At least one more cut is seen likely in 2024.

Along with the Sept. 4 rate move from the Bank of Canada, the ECB meeting’s timing – days before the Federal Reserve’s own initial reduction expected on Sept. 18 – underscores how large advanced economies are now shifting more in tandem as officials pivot to supporting economic growth now that they judge inflation risks to have faded.

In the euro zone, easing in a key measure of wage growth during the second quarter will have helped embolden policymakers.

Similarly, a US consumer-price report due on Wednesday may offer Fed officials reassurance that inflation pressures are stabilizing, on the heels of data on Friday that showed US hiring fell short of forecasts.

For investors, the question hanging over this month’s meetings is the extent to which such rate reductions herald a deeper easing cycle that may not only remove constriction on major economies, but also begin to stimulate them.

What Bloomberg Economics Says:

“We expect the ECB to cut by another 25 basis points in December. However, the elevated rate of wage growth and sticky services inflation should cause the Governing Council to refrain from committing to that in advance.”

—David Powell, senior economist. For full analysis, click here

Prospects for growth will be a focus when ECB President Christine Lagarde addresses journalists on Thursday — not least in light of just-released data showing second-quarter expansion was weaker than initially reported.

Governing Council officials are thought to be more comfortable changing rates at meetings like the upcoming one, when they have newly-produced quarterly forecasts at hand. That would make a further cut in December more probable than one at their next gathering on Oct. 17.

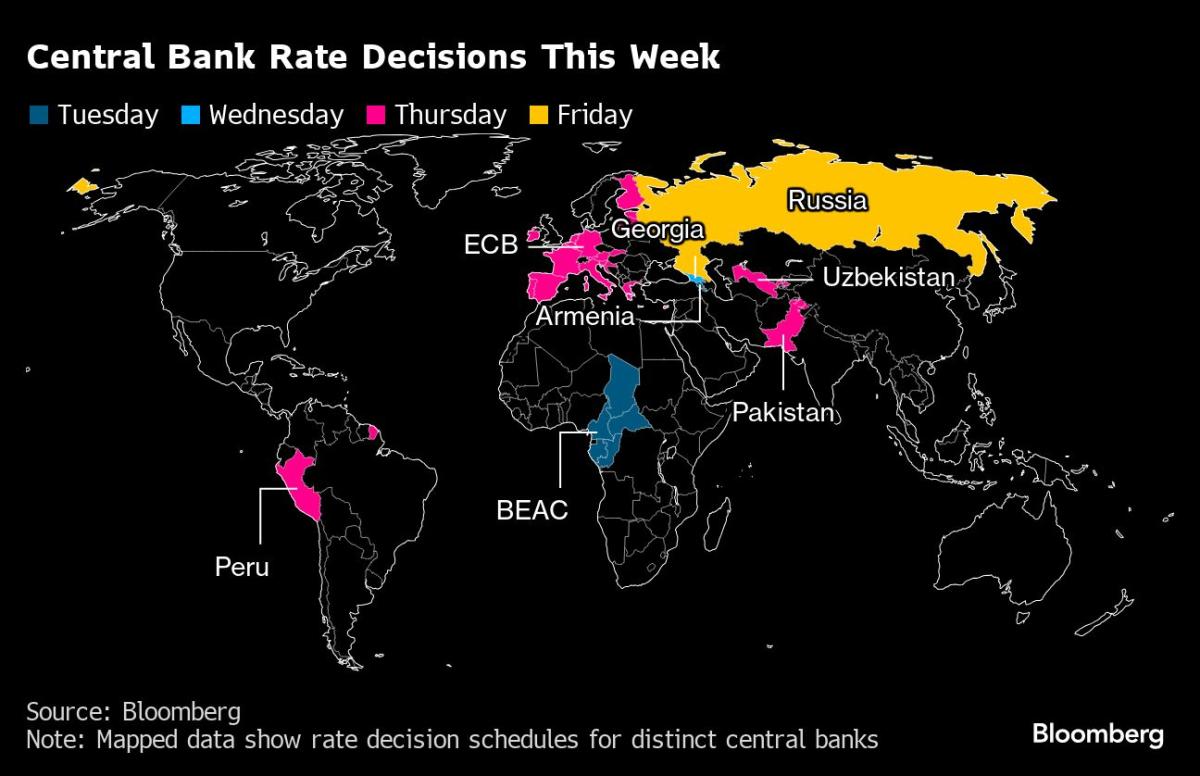

Elsewhere this week, Chinese inflation data, UK wage numbers and rate decisions from Pakistan to Peru are among the highlights.

Click here for what happened last week, and below is our wrap of what’s coming up in the global economy.

US and Canada

Fed officials are entering a blackout period from public events before their meeting. Ahead of that, Governor Christopher Waller said after Friday’s jobs report that it’s important to begin cutting rates. Waller also noted that he’s “open-minded” about the potential for a larger reduction. “The current batch of data no longer requires patience, it requires action,” he said.

The labor market is on the front burner for Fed policymakers as price pressures have cooled. The August CPI report is expected to show a measure of core inflation, which strips out food and energy, rose by 0.2% for a second month. On a year-over-year basis, the core CPI probably increased 3.2%, matching the annual figure for July that was the smallest since 2021.

Other US data in the coming week include August producer prices, weekly jobless claims and the University of Michigan’s preliminary September consumer sentiment survey.

Looking north, Bank of Canada Governor Tiff Macklem will speak in London about shifts in global trade and investment from a Canadian perspective, and will take questions from reporters. Meanwhile, national balance sheet data will shed light on households’ net worth and debt-to-income ratio in the second quarter.

Asia

China is front and center, beginning with data Monday that’s expected to highlight the ongoing fragility of domestic demand.

Consumer inflation is seen picking up just a bit, to what would still be an anemic 0.7% pace, while declines in factory-gate prices are forecast to deepen.

Data at the end of the week may add to the gloom, with growth in industrial output, retail sales and fixed asset investment all likely to have moderated in August, while property investment is seen falling at a double-digit clip for a fourth straight month.

Elsewhere, Japan’s economic rebound in the second quarter may be revised a tad higher after solid capital investment data for the period are factored in.

India’s August inflation data on Thursday could tip the Reserve Bank of India toward an October rate cut, according to Bloomberg Economics, which expects price growth to slow for a second month.

Trade numbers are due during the week from China, India, Taiwan and the Philippines, and Australia gets gauges for consumer and business confidence on Tuesday.

On the monetary front, Pakistan’s central bank is expected to cut its benchmark rate on Thursday for a third straight meeting. Its counterpart in Uzbekistan also decides policy that day.

Europe, Middle East, Africa

UK data may draw the attention of investors. Wage numbers on Tuesday are likely to show weaker pay pressures, though the annual pace of increase still remains more than double the Bank of England’s 2% inflation target.

Monthly gross domestic product on Wednesday is expected by economists to show a modest increase in July, pointing to a lukewarm start to the third quarter. And the BOE will release its latest inflation expectations survey on Friday.

Turning to the euro zone, industrial production numbers in Italy, Spain and the region as a whole will also point to the condition of the economy there as it began the second half of the year. Based on the performance of Germany and France, in data released on Friday, it’s likely the wider economy was on a weaker footing.

In Germany itself, Finance Minister Christian Lindner will present the country’s 2025 budget to parliament on Tuesday, followed by remarks the next day by Chancellor Olaf Scholz and other government ministers.

Elsewhere on the continent, inflation numbers in Norway and the Czech Republic on Tuesday, and in Sweden on Thursday, will be watched closely as central bank policymakers assess the lingering strength of price pressures.

Turning south, traders will watch Egypt on Tuesday to see if inflation slowed for a sixth straight month. It reached 36% in February but has since fallen below 26%, thanks in large part to a huge international bailout.

Similarly, a report on inflation expectations on Thursday will inform policymakers at the South African Reserve Bank, which uses two-years-ahead numbers to guide its decision making. A drop toward the 4.5% midpoint, where the central bank prefers to anchor them, will add impetus for its first rate cut since the height of the pandemic.

Aside from the ECB, a couple of other rate decisions are scheduled:

On Thursday, the National Bank of Serbia may leave its rate at 6% after inflation rose in July for the first time in more than a year.

The following day, attention will focus on whether the Bank of Russia continues tightening after hiking borrowing costs by 200 basis points in July. Data on Wednesday may show inflation there has passed an annual peak.

Finally, the International Monetary Fund is due to complete a review of Ukraine’s economy and finances in the coming week, and will announce whether the lender’s board should approve the next slice of a $15.6 billion loan for the war-torn country.

Latin America

Latin America’s three largest economies will report August consumer price data as the region’s central bankers recalibrate their monetary policy.

On Monday, Mexico’s national statistics institute will likely report that inflation eased to 5.05% from 5.57% the month prior. The nation’s cost of living has been propelled by soaring prices of services, fruits and vegetables in recent months.

Still, the expected slowdown now will give the central bank more room to consider another rate cut later this month to bolster a weak economy.

The next day, Brazil is expected to report that inflation fell back from the 4.5% ceiling of the central bank’s tolerance range. Any decline stands to provide limited relief; policymakers face pressure to lift borrowing costs in September due to price risks including increased public spending, robust economic growth, and a depreciated currency.

Finally, Argentina will release its data on Wednesday as President Javier Milei’s administration touts progress in efforts to tame the cost of living.

Monthly price increases have indeed waned from 25.5% in December — when Milei’s government took office — to 4% in July. Annual inflation is still well above 200%.

–With assistance from Matthew Malinowski, Brian Fowler, Laura Dhillon Kane, Monique Vanek, Paul Wallace and Tony Halpin.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.