On October 1, 2024, Fund 1 Investments, LLC (Trades, Portfolio) made a significant addition to its portfolio by acquiring 2,538,000 shares of Vera Bradley Inc (NASDAQ:VRA), a renowned player in the Manufacturing – Apparel & Accessories industry. This transaction, executed at a price of $5.04 per share, reflects a strategic move by the firm, impacting its portfolio by 0.14% and increasing its total holdings in the company to 2,709,955 shares. This acquisition not only enhances the firm’s stake in Vera Bradley to 9.60% but also represents 1.48% of its total portfolio.

Fund 1 Investments, LLC (Trades, Portfolio), based in Rincon, PR, operates as a dedicated investment entity with a focus on delivering substantial returns through strategic stock holdings. The firm’s investment philosophy emphasizes a selective approach, targeting companies with potential for significant value appreciation. Currently, the firm manages an equity portfolio worth approximately $924 million, with top holdings in diverse sectors such as Consumer Cyclical and Communication Services. Some of its major investments include BJ’s Restaurants Inc (NASDAQ:BJRI), Citi Trends Inc (NASDAQ:CTRN), and Hibbett Inc (NASDAQ:HIBB).

The recent acquisition by Fund 1 Investments, LLC (Trades, Portfolio) is poised to have a notable impact on its portfolio dynamics. The addition of Vera Bradley shares significantly bolsters the firm’s position in the retail and consumer goods sector, aligning with its strategy to capitalize on market segments demonstrating robust growth potential. This strategic move underscores the firm’s confidence in Vera Bradley’s market position and future growth trajectory.

Vera Bradley Inc, established with its IPO on October 21, 2010, is a distinguished designer of women’s handbags, travel items, and accessories. The company operates through three segments: Vera Bradley Direct, Vera Bradley Indirect, and Pura Vida, with the majority of its revenue generated from the direct sales channel. Despite the challenges in the retail sector, Vera Bradley continues to innovate and expand its product offerings, primarily in the United States.

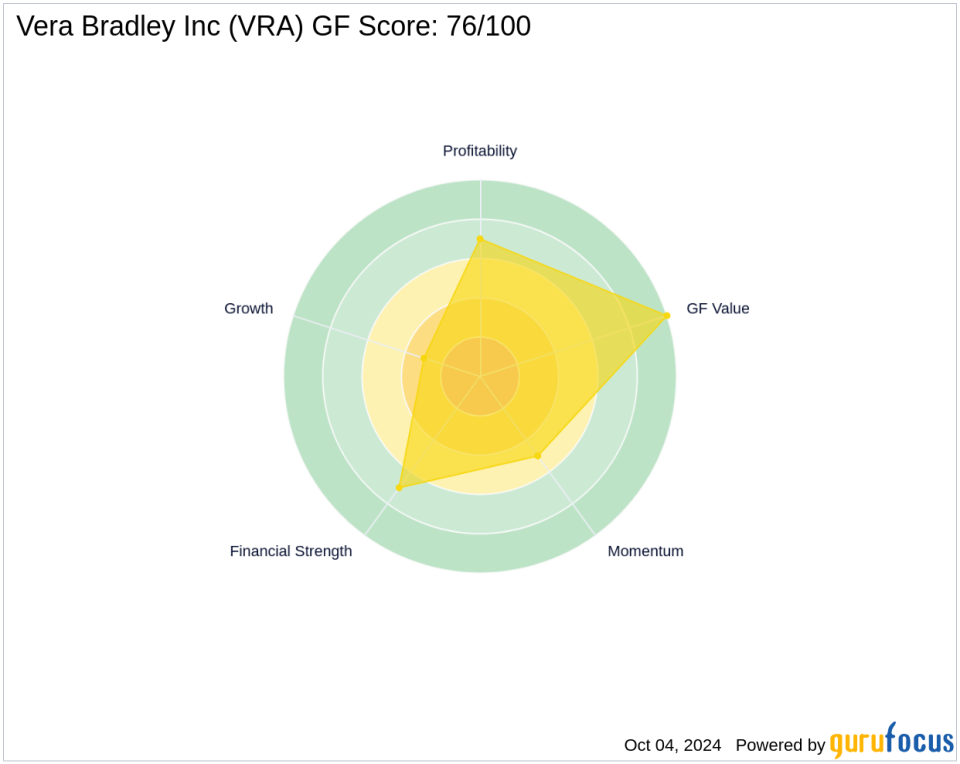

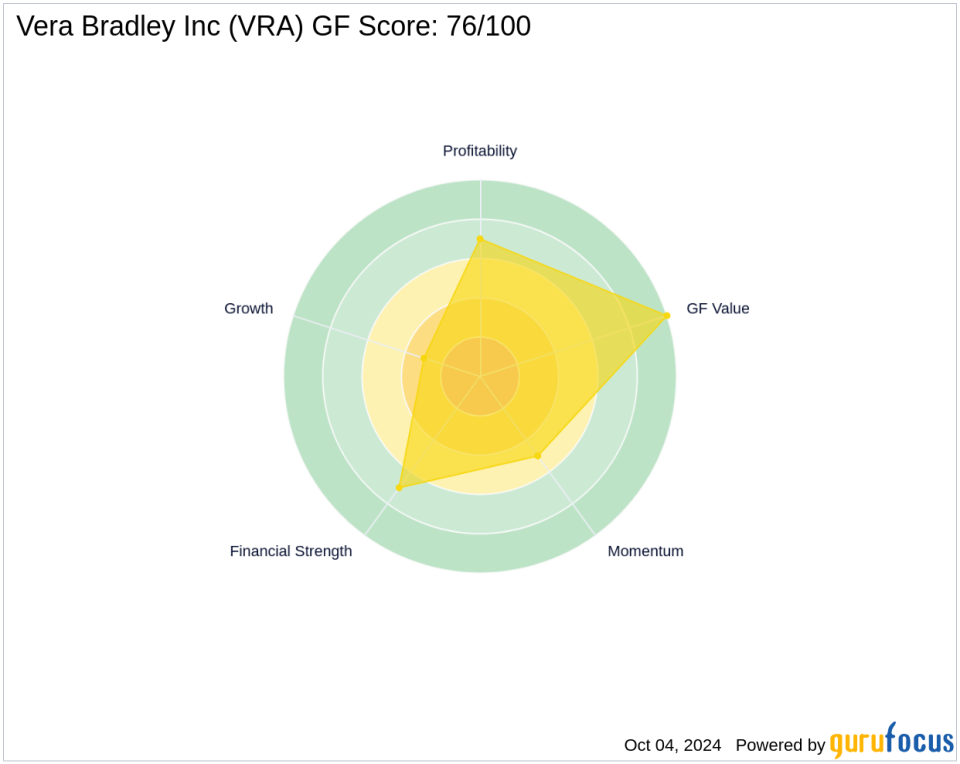

As of the latest data, Vera Bradley boasts a market capitalization of $143.948 million, with a current stock price of $5.10. The company is rated as modestly undervalued with a GF Value of $5.87. Despite a challenging year with a 31.91% decline in stock price YTD, the company maintains a GF Score of 76, indicating potential for future performance. The firm’s financial strength and profitability are commendable, with a Piotroski F-Score of 8, suggesting good health and operational efficiency.

The investment in Vera Bradley by Fund 1 Investments, LLC (Trades, Portfolio) comes at a time when the company is poised for revitalization. With a solid foundation in design and retail, coupled with strategic initiatives aimed at market expansion, Vera Bradley is expected to navigate the competitive landscape effectively. Investors should consider the company’s growth potential, current valuation levels, and the strategic interest demonstrated by seasoned investors like Fund 1 Investments, LLC (Trades, Portfolio).

The acquisition of Vera Bradley shares by Fund 1 Investments, LLC (Trades, Portfolio) marks a strategic enhancement to its portfolio, reflecting confidence in the company’s future. This move is aligned with the firm’s investment philosophy and its focus on sectors with robust growth prospects. As Vera Bradley continues to evolve and expand its market presence, this investment may well prove to be a pivotal point in the firm’s investment strategy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.