- Bitcoin’s RSI indicated potential rebounds for altcoin market, specifically RUNE, RNDR, and ADA.

- Despite market lows, technical analyses suggested that select altcoins might offer promising investment opportunities.

The cryptocurrency market, particularly the altcoin sector, has experienced a significant downturn after reaching a peak market capitalization of $1.28 trillion in March.

Recently, the market cap dipped below the $1 trillion mark, signaling a bearish phase that has left many investors cautious.

Bitcoin RSI Says BTFD

However, this period of decline may also present buying opportunities, as indicated by key technical analysis from notable crypto analysts.

Sheldon The Sniper, a well-regarded figure in the crypto analysis community, has highlighted how Bitcoin’s Relative Strength Index (RSI) can be used to identify potential buy zones.

This includes altcoins like THORChain [RUNE], Render Token [RNDR], and Cardano [ADA].

According to Sheldon, when Bitcoin’s RSI dips into certain levels, it often precedes rallies in select altcoins.

This has been observed with the likes of RUNE and ADA, which historically show strong recoveries when their RSI readings fall below 40% on the weekly charts.

This suggests that despite the broader market’s struggles, there are pockets of potential that could benefit astute investors.

As of press time, Bitcoin was trading at $60,746, with a 1.5% decrease in the last 24 hours, and its RSI had reached a critical zone that could indicate an impending shift in market sentiment.

Analyzing altcoins: Cardano as a case study

While Sheldon has highlighted RUNE, RNDR, and ADA as potential buys, it would only make sense to delve into one of these altcoin fundamentals to verify if they truly present attractive investment opportunities.

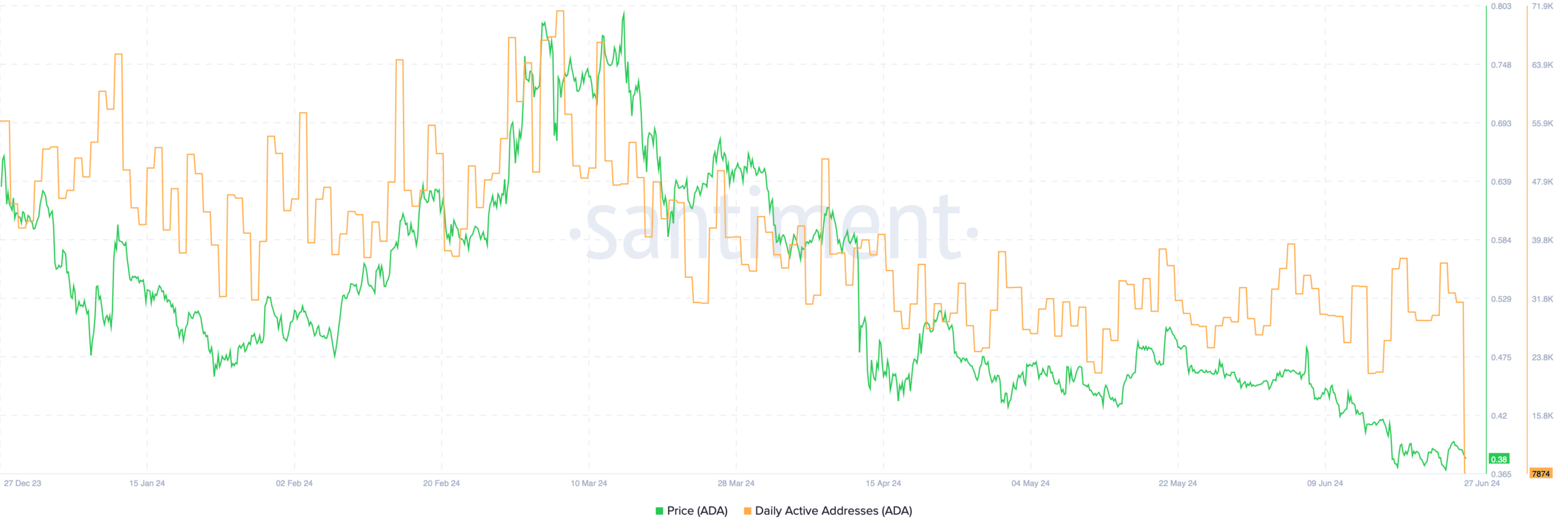

Now, using Cardano as a case study. Data from Santiment indicated that Cardano’s daily active addresses have significantly decreased, falling from 36,000 on the 24th of June to just under 8,000 recently.

This sharp reduction suggested diminishing network activity, which could negatively impact ADA’s price.

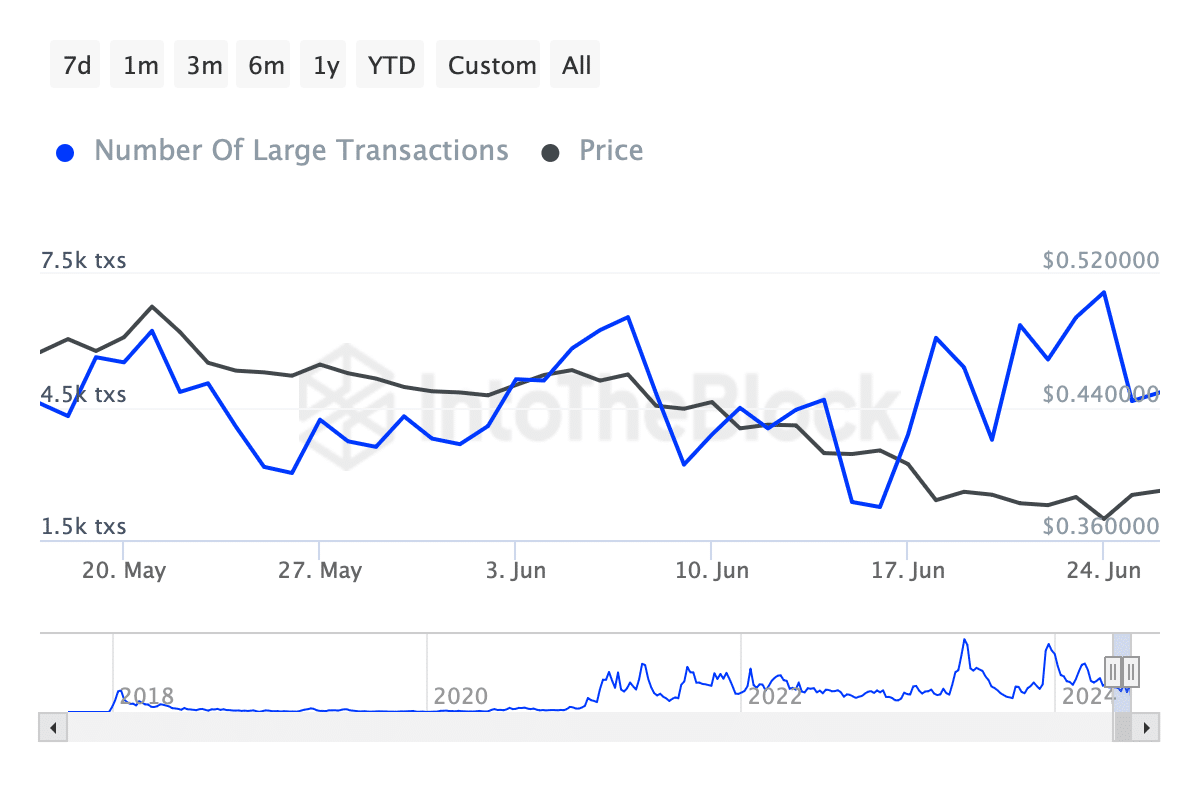

Furthermore, IntoTheBlock data reveals that large-scale investors, or whales, may currently find ADA less attractive.

The number of transactions exceeding $100,000 has declined from 7,000 on the 24th of June to 4,000 at press time, signaling a potential withdrawal of investor interest.

This trend is mirrored in the asset’s Open Interest, which, according to Coinglass, has decreased by 2.74% in the past day to $203 million.

Conversely, there has been a significant increase in Open Interest volume, which surged nearly 50% to $307 million, indicating mixed market signals.

Read Bitcoin’s [BTC] Price Prediction 2024-25

These downward trends in key metrics not only suggested a price decline but also have placed about 74% of ADA holders at a loss, as reported by AMBCrypto.

This situation poses a critical question: will this lead to increased selling pressure?