A record spike in travel numbers is expected in the United States over the Independence Day holiday period due to a rise in disposable income and a resilient labor market. Flexibility from remote working environments coupled with summer vacations are also reassuring Americans to take extended trips during the holiday season.

Given the increased travel demand, airliner SkyWest, Inc. SKYW and cruise company Royal Caribbean Cruises Ltd.’s RCL shares are well-positioned to gain. Similarly, more travel should boost hospitality company Hilton Worldwide Holdings Inc.’s HLT occupancy rate and its revenue generation per available room (RevPAR).

A whopping 70.9 million travelers are projected to head 50 miles or more from their residency during the Independence Day holiday period, which includes the entire July 4 week, per the American Automobile Association (AAA).

This year’s expected travel forecast over the Independence Day holiday period represents a jump of 5% from last year and a healthy increase of 8% over 2019. In reality, this time around, travel is anticipated to surpass the pre-pandemic numbers.

AAA added that a record 60.6 million travelers will take to the road during the Independence Day holiday period, which is more than 2.8 million from last year’s numbers. It’s also way more than 2019’s number of 55.3 million travelers.

Rental demand has skyrocketed, and Jul 3 is projected to be the busiest pick-up day. Planning a road trip, by the way, is on almost everyone’s mind since gas prices have fallen from last year’s national average of $3.53.

Moreover, around 5.74 million travelers are expected to fly to their Independence Day holiday destination, up 7% from last year and 12% from 2019.

Cheaper domestic airfare at the moment does bode well for air travelers. Lest we forget, Airlines for America has already projected 271 million passengers to fly during the summer season, which is a record number for the airline industry. National carriers are undoubtedly adding more seats to accommodate the surge in air travel.

Meanwhile, transport by other means, including cruises, buses and trains, is likely to be more than 4.6 million, up 9% from last year. Cruise ships, particularly, are offering targeted discounts to lure passengers this summer.

Additional disposable income is expected to drive travel during Independence Day, building on a busy summer vacation. Disposable personal income increased $94 billion or 0.5% in May from the prior month, according to the Bureau of Economic Analysis.

Job additions and higher wages despite elevated interest rates are also encouraging Americans to travel. Job openings climbed to 8.14 million in May from April’s downwardly revised number of 7.91 million, per JOLTS report. At the same time, wage growth remains steady after solid acceleration in the first quarter.

Strong labor market conditions, increase in disposable personal income, and cheaper gasoline prices are expected to prompt a record number of Americans to travel this Independence Day holiday period, which bodes well for stocks such as SkyWest, RoyalCaribbean Cruises and Hilton. Thus, astute investors should keep an eye on these stocks for noteworthy gains.

Regional airline SkyWest currently has a Zacks Rank #2 (Buy). The company’s efforts to modernize its fleet and initiatives to acquire potential players in the market are expected to ebb anxieties about rising operational costs. You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

The Zacks Consensus Estimate for SKYW’s current-year earnings has moved up 0.3% over the past 60 days. SKYW’s expected earnings growth rate for the current year is an overwhelming 787%.

Miami-based Royal Caribbean Cruises presently has a Zacks Rank #2. The company’s ingenuities to modernize digital travel and robust booking trends among loyal customers are helping RCL’s shares scale northward.

The Zacks Consensus Estimate for RCL’s current-year earnings has moved up 2.8% over the past 60 days. RCL’s expected earnings growth rate for the current year is a superb 64%.

Lastly, Hilton has a Zacks Rank #3 (Hold). The company’s fee-based business model and improvements in RevPAR are helping Hilton’s shares move upward.

The Zacks Consensus Estimate for HLT’s current-year earnings has moved up 0.3% over the past 60 days. HLT’s expected earnings growth rate for the current year is a promising 13.9%.

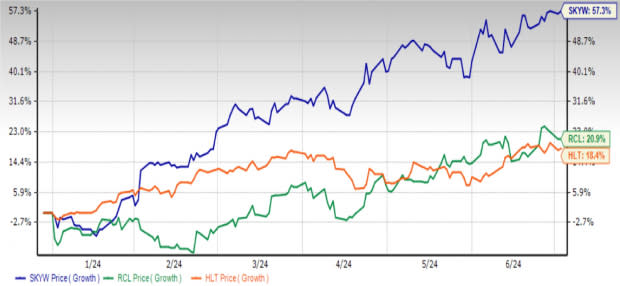

Shares of SkyWest, Royal Caribbean Cruises and Hilton have gained 57.3%, 20.9% and 18.4%, respectively, so far this year.

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

SkyWest, Inc. (SKYW) : Free Stock Analysis Report

Hilton Worldwide Holdings Inc. (HLT) : Free Stock Analysis Report