When prepping for June’s Eye on ESI webinar, I told ACEDS President Mike Quartararo that the current job market trends we have been tracking were unusual and contradictory, he seemed surprised. However, the info we shared this month proves how quickly the pendulum can swing toward both good and bad news.

The basis of the trends, what we track, and why they are important can be found in TRU’s 2024 eDiscovery Jobs Report.

Quite honestly, May was a contradiction in terms. The trends were very milestone-driven, very unusual and often contradictory. Here is where we stand as of early June in the ESI job market. Prepare to be amazed.

In May, TRU recruiters saw the highest number of declined offers of any month this year. This happened because candidates are now getting multiple offers at the point of hire. If the candidates pick one of the offers, it stands to reason that the others will be declined.

There is a high demand for the same types of candidates within a certain salary range and hiring managers are fighting over the same candidates.

Even though many candidates want to leave their current roles, they are declining new roles and are either taking counteroffers (and this is a trend we haven’t seen in 18 months) or are just deciding to leave the job market.

So, if you are considering a job move and have been passive about it, now is good time to activate your job search – particularly if you are in the middle range of the market (project managers, analysts, etc.). You are in hot demand.

Last month, TRU also saw the largest number of inbound resumes we’ve seen in the last 12 months. People are looking for new opportunities, but they are being really, really picky about the roles they will consider. More about this in number four!

In May, TRU also had the lowest number of first-round interviews. The speed of hire has slowed significantly since late last year, especially for law firms. This is troublesome because the talent pool is smaller for the roles they are trying to fill, and hiring managers risk losing the candidates while they drag out the process.

You can see how long it takes in the slide above. Many of the executive positions available months ago are still open, many of the project management jobs particularly at law firms are still open, and those are the things that are dragging this timeline higher.

However, there are two bright spots: ESI sales hiring has sharply accelerated with vendors, who are making tactical and speedy choices. ESI vendors are spending more on salespeople, trying to get great talent in the door to invigorate sales in Q4 and Q1 2025. Also, contract hiring is still happening rapidly to fill gaps, alleviate burnout, and cover summer vacations.

The slide above is fascinating. TRU did a trailing report of how long jobs are taking to fill by organization type, going back 90 days. Look at the median averages by month. Vendors are filling roles far faster because they are hiring fully remote employees. The volume of candidates they must explore is huge, and the interest of available candidates is extreme. Law firms have open roles dating back months and they are really struggling to hire with strict in-office mandates.

It is what it sounds like. We are all playing a game of ESI chicken. Who will blink first? It is a very polarized marketplace in ediscovery right now. Job seekers are holding very firm to what they are looking for in a new role. They are not willing to compromise on going into an office on a regular basis and wanting they want more money if they need to commute. Rather than cave in, candidates are walking away from offers. Employers are also holding the line in terms of what they want as well – more time in an office and paying within a certain range.

On the slide above, you’ll see that candidates have gradually stopped accepting the first offer they received. They are more likely now to accept a second offer. Look at the difference since 2022.

The motivations for seeking roles are currently fueled by four things: firms being understaffed, workers feeling underpaid, feeling undervalued, or workers are bored with their current roles. In past years, people moved toward positive change instead of running away bad experiences. This trend points to burnout being a primary motivator.

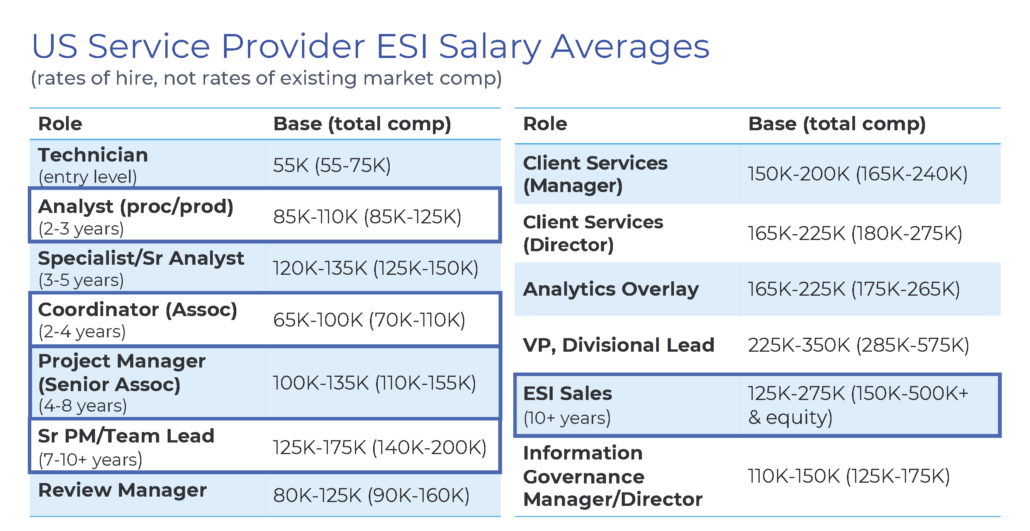

In the slide below, the boxed salary range areas are the roles most in demand right now. They are mostly in the middle of the marketplace.

There is one reason why candidates are passing on offered roles: law firms have in-office requirements. Most of the full-time, direct hire roles now available are at law firms, who have upped their technology in-house and want to capitalize on it. Most of these jobs require two or more days in an office. Candidates with experience are turning them down and are being very choosy about which roles they will or won’t accept, especially if a firm won’t pay a premium for in-office presence.

There is many open roles, and a small pool of candidates willing to interview for these roles. To fill them, employers may need to start offering more incentives (like increasing salaries) to get candidates interested.

[View source.]